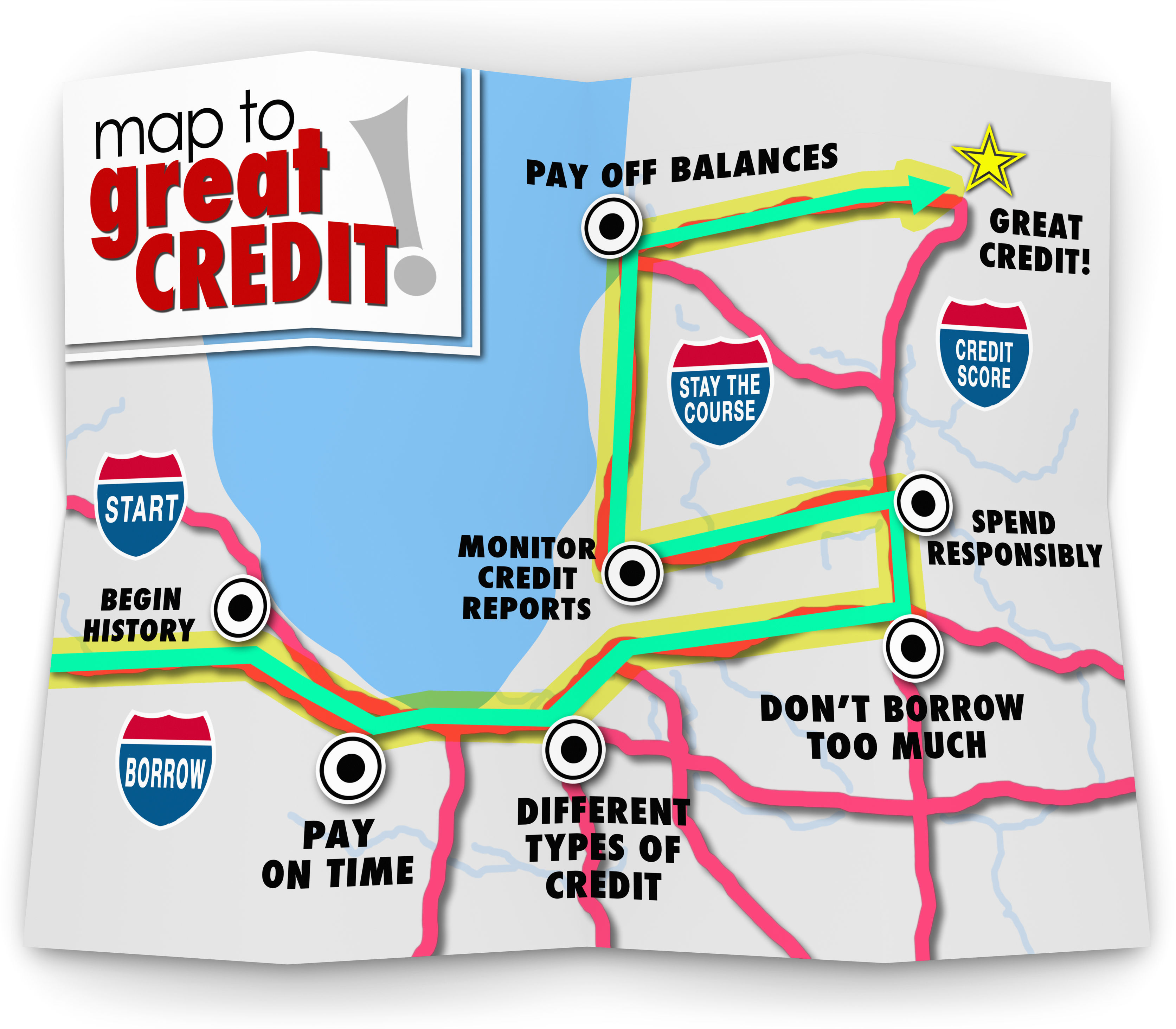

Whether you are opening your first credit card or need a refresher, these credit card best practices are essential to maintaining a healthy credit score. While you may think you have your credit cards under control, there may be a few items on this list that can help you to improve.

Here’s the Rundown..

Look For A Low Interest Rate: When you are on the market for a new credit card, be sure to check the interest rate and annual fee. Read the cardholder agreement! It will give you insight into all the fees you can be charged. Don’t be afraid to ask questions before opening a new card.

Don’t Spend More Than You Can Afford: Don’t buy a TV that costs as much as your credit limit, just because you can. Purchase what you can afford to pay off at the end of that month. This will enable you to avoid interest fees.

Pay On Time: Show lenders you’re reliable, pay your credit card on time! You don’t want to pay that late fee. Also, be sure to check when your payment is due each month, it can change from time to time

Pay Off As Much As You Can: At the very least pay the minimum balance. Pay off the entire balance whenever you can, to reduce the finance charges you pay. As a rule of thumb, pay off as much as you can to avoid high interest payments. When you do have to keep a balance on your credit card try to keep it below 30% or less.

Avoid Cash Advances: When you choose to do a cash advance, a fee and interest rate is typically part of the deal. Interest rates for cash advances tend to be much higher. Only do a cash advance if it is an emergency.

Stay Within Your Limit: Keep track of what you are purchasing each month. If you stay within your limit, you’ll avoid over limit fees. Keep your credit card balance below 70% of your limit at all times. This shows lenders that you have control over how much credit you use.

Use Your Credit Card Regularly: Use your credit card regularly with the mindset that you will pay it off at the end of the month. This will show lenders that you have a proven history with being able to handle your money responsibly.

If you have tried time and time again to put these steps into play in your daily life but can’t seem to get anywhere, there is help.

Don’t wait! Better Credit is just a click away! Call the experts at Nationwide Credit Clearing. “Home of the Free Credit Report and Consultation”

Nationwide Credit Clearing

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

Follow us …