-

Get A free

Consultation Now!

Tag Archives: Credit Repair

Three Common Credit myths

The media, newspapers, tv and the web are full of information, but sadly, most of the information regarding credit happens to be completely innacurate.

Below you will find 3 very common credit myths.

Credit Myth #1: “If I get one credit bureau to remove an item from my credit report, the rest of the bureaus will remove it just as well..Unfortunately, this is not the case. Each of the three bureaus are independent companies. They don’t automatically work together with each other when considering deletion of items on your credit report, the truth is that all 3 of them are competitors of one another. You will have to contact & work with each bureau separately to get any negative, outdated or incorrect items removed from your credit report. All this redundant work is a significant reason so many Americans consider using credit repair companies such as Nationwide Credit Clearing to help them with this lengthy and very complex process.

Credit Myth #2: “Your yearly income or salary plays a role in your credit score.” Believe it or not, the credit scoring models don’t take salary as a consideration in any way. They do not want to discriminate based upon wages or personal income, and because of this, you could have a high paying job, but still have a very poor credit score.

Credit Myth #3: “Including a consumer statement to your credit profile can make a large difference.” Unfortunately this does not make a difference in your credit scoring at all. To be quite honest, the reality is that there’s no point in adding any type of consumer statement mainly because if you’re in a dispute with the way an item is reported, you have the ability to, by law, add a statement. However, if you are able to get the item corrected or removed because of its inaccurate reporting, having that statement would likely reaffirm the fact that it should have ended up there in some way, shape, or form. So, it’s better to just not tell your personal story, because the likelihood of anyone reading it is slim to none.

Nationwide Credit Clearing

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

All about your Credit Score

Your Credit History plays a huge role in everything you do in life. From getting a job to applying for loans, your credit score is factored in everywhere. A credit score is a screenshot taken by the 3 major credit bureaus, Experian, TransUnion, and Equifax. This gives lenders the ability to determine whether or not you will be given credit, the total amount of credit you are granted as well as the terms on your loan, (loan amount, interest rate and repayment schedule).

Below you will find information about credit scores as well as some simple steps to keep them high, all which are crucial for you in determining your financial future.

What is a credit score and how is it calculated?

Your credit score is usually a number that ranges between 300 & 850 and it’s used by creditors to determine if you are responsible and worthy of obtaining credit based on many factors. Many of the businesses that you have a credit line or a loan will send reports to these 3 bureaus of credit info such as whether or not you pay bills on time, your total credit amount, and even your credit history going back many years. A credit score is calculated simply from your individual credit history. Someone with a higher credit score, will have the ability to borrow more money. However, when your credit score is low, you may be able to obtain loans, but your interest rates will be much higher. Generally, a score of 700+ is considered GOOD while a score of 600 or below is considered very POOR.

Everyone has the ability and should take the opportunity to get a free credit report from each of the 3 bureaus once per year. All three bureaus offer this to us, but many of us don’t take advantage nor pay attention. It’s important to check your credit score to determine if it’s accurate because your score will be used to determine your financial future.

So How do I increase my credit score?

This is not a quick fix, when trying to increase your credit score, however, you can take steps to repair your score over time.

Here is our advice:

*Payment history is important so always pay your bills on time

*You never want to max out any of your credit cards. In fact, keeping your balance at 30% of your total limit is ideal.

*Don’t apply for new credit unless it’s absolutely necessary.

*Even when you pay off a card, keep it open to increase the length of your credit history

*Pay your high balance cards first, and never just transfer debts among a variety of lenders.

*If you have collections or past due accounts, settle them

*If you find inaccurate items in your credit report, make sure to dispute them.

*Usually, The last 2 years of your credit history are the most valuable

Your Credit Score will affect your life in many ways.. good or bad!

Credit scores are often used in determining prices for home or car loans as well as homeowners insurance. Employers will also check your credit score as part of background checks when making the final decision as to whether to hire you or not. Although it may not seem fair, credit scores have become more prevalent and are now used in nontraditional ways to judge you as a person.

Nevertheless, It’s more important than ever to become educated about Credit Scores.

This leads us to the final question.. When was the last time you checked your credit score?

If it’s been a while, Nationwide credit Clearing can help. We are the leaders in Credit Repair and are here to help you in making your future financial decisions or correcting mistakes you have made in the past.

So what are you waiting for? Call Nationwide credit Clearing today and get started with your free credit report and consultation.

Nationwide Credit Clearing

2336 N Damen

First Floor

Chicago, IL 60647

773-862-7700

877-334-3296

FAX: 773-862-7703

Credit Q & A from Nationwide Credit Clearing

At one time in our lives, we have all made financial decisions, good or bad, that have come to affect our overall credit score. Our Credit Score ends up determining the path of our financial future.

Whether you have bad credit, bankruptcy, delinquencies, derogatory remarks or even wrong information on your credit report, watch some of these videos for your own personal knowledge or to see how Nationwide Credit Clearing can help you.

CHECK YOUR CREDIT REPORT AT LEAST ONCE/YEAR

THERE IS HELP AFTER BANKRUTPCY

HOW TO IMPROVE YOUR CREDIT AND SAVE ON INTEREST PAYMENTS

SIGNING UP FOR CREDIT CARDS AT DEPARTMENT STORES

WHAT IS A CREDIT REPORT?

Nationwide Credit Clearing is the leader in Credit Repair in the United States.

We always have to ask, When was the last time you checked your credit report? If it’s been over a year, this is where Nationwide Credit Clearing can help. Nationwide Credit Clearing has over 20 years of experience repairing credit for thousands of individuals. We have helped so many people improve their credit score by removing inaccurate, misleading or unverifiable information, ultimately changing their lives forever. We deleted over 25,000 items from credit reports in the past year.

There’s no reason to put this off and there certainly is no time like the present. Give us a shout here at Nationwide Credit. After all, We are the home of the free credit report and consultation!!

Nationwide Credit Clearing

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

How Often is My Credit Report Updated?

When it comes to timing and payment of credit cards, information is not updated as frequently as most consumers would like for it to be.

Credit report lag is a huge cause of confusion for Consumers. Once you pay off a credit card, it becomes exciting to see the changes this makes on your overall score; however, credit reports are not updated right away, meaning you may not see a change for a little while. Ugh… How disappointing!!

Prior to deciding to freak out and believe something must be incorrect understand that, generally, creditors forward info like balance updates and new accounts to credit reporting agencies monthly, not daily. The primary factor to take into account is not that every financial institution reports to all 3 of the credit bureaus unfortunately. Additionally, each creditor updates their system on different days of the month, so although you may have paid off all of the credit cards on the same day, the latest balances most likely are not going to be reported at the same time.

You should always familiarize yourself with how public records & hard inquiries are reported. When it comes to hard inquiries, like applying for loans, credit bureaus update inquiry information right there and then, which means you can view this info pretty much as soon as it is dispatched. However, when it comes to public records such as bankruptcies, tax liens & judgements, the process is never the same. Even if you have addressed a long standing delinquency, the credit bureaus more than likely will not receive the updated info right away, especially since every court has different conditions when reporting public records.. In general, negative marks usually stay on your credit report for many years, so many times; a quick fix just isn’t possible. Of course it’s not what we want, but it just is what it is.

Since changes do take some time, it is very important for you to remain patient in seeing positive changes. If you can give it a month or maybe even 2 before you expect the changes, this will allow you to keep your sense of sanity.. So just keep that in mind. However, it is always to remain mindful about when you have made pmts or had negative marks eliminated, how many accounts you ought to have open along with the info that all 3 bureaus have on your file. In the event that you notice incorrect or outdated information on your credit report, you’ll be able to file a dispute with the 3 credit bureaus that are reporting the wrong information. If you need help figuring out how to dispute something on your credit report, call Nationwide Credit Clearing.

All in all, nothing will help keep you on top of things like a little bit of patience and diligence. So the next time you check on your credit, keep in mind patience is a virtue!!

On another note, if you have not even checked your credit report due to you being afraid to see what is on there, it’s not doing you due diligence. This is where Nationwide Credit Clearing comes in. Nationwide Credit Clearing has over 20 years of experience repairing credit of all types. We have helped thousands of people improve their credit score by removing inaccurate, misleading or unverifiable information. We deleted over 25,000 items last year alone.

So don’t be afraid, there is no time like the present. Give us a shout here at Nationwide Credit. We are the home of the free credit report and consultation!!

Nationwide Credit Clearing

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

Your Credit Score & Credit Utilization Rates Have A Very Distinct Relationship

One of the most important things credit companies do to factor in your total credit score is they look at your balance to limit ratio. Your rate of utilization is simply the percentage of the total limit based upon your current balance.

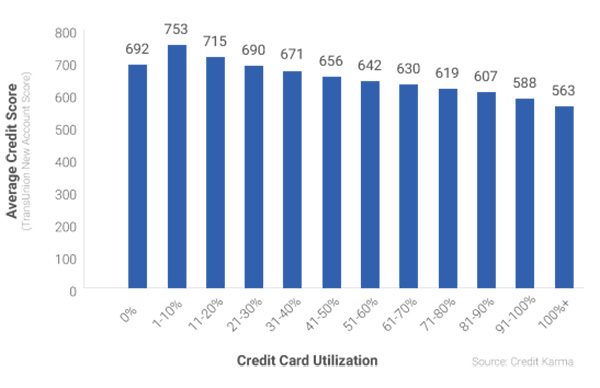

To illustrate how important this factor is, Credit Karma sampled approximately 15 million Credit Karma members who visited the site in 2014 and compared their credit scores and corresponding credit card utilization rates. (Graph Provided by Creditcarma.com)

The Facts:

The correlation here is very easy to see. If you max out your card, and don’t pay it down, you are going to have problems. The lower the utilization rate, the higher your score, that is, with the exception zero utilization. As you can also see, not using your card at all is not the best option. The better choice would be to use the card for purchase during the month, then always keep that utilization at about 30%. This gives you credibility and proves to creditors that you can be responsible with money.

What this Means…

Lenders don’t like high utilization rates because it tends to indicate there’s a higher chance of you not being able to repay debt. Keeping your credit card utilization low at about 30% is the most ideal range. Creditors need to see proof, long term, that you can manage money and credit–something you can’t do without using the credit you’re granted.

If you’re uncomfortable with the idea of using your card for large purchases, you can still show an active credit profile by paying for small items with your card. It’s important that you practice good habits when managing your credit cards. Charge what you can pay back and make sure your payments are on time. In order to keep your utilization rate greater than 0%, you’ll need to let your charges show up on your billing statement, and then you can pay it off in full. This does not mean you need to carry a balance from one month to the next–doing so may just cost you money in the form of interest.

Credit utilization is just one of many factors when generating an overall score

Credit card utilization % is definitely an important aspect of your credit worthiness, and more than likely will have a significant impact on credit health, but it’s not the only factor these lenders care about. Basically, and what it comes down to, is it is not impossible for people who have high credit utilization rates to still have good credit scores, just as long as the other factors are all good– but it’s definitely not something that typically happens.

Question: When was the last time you even Checked your Credit Score?

If it’s been a while, it’s probably time to catch up. Nationwide Credit Clearing is the home of the free credit report and consultation. Not only will we provide you with an accurate view of where you stand as far as credit worthiness, but we can then help you by taking the existing derogatory items, late payments, etc.. and helping to remove them from your credit altogether.

We have helped thousands live a better life, free from credit hangups. Call today for your free report!

Nationwide Credit Clearing

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

Lower credit score?

How is it that you can actually get a lower credit score when you feel like your spending habits have gotten better? Learn why your credit scores might have dropped since you last checked them by using this informative infographic below:

In summary, here are 5 solid reasons your credit score may have recently dropped:

1. 30 plus days late on payments

2. Credit Card balances exceed 30% total

3. Closing an old account

4. Too many Credit Card Inquiries

5. Identity Theft may have racked up debt without you knowing.

If this seems overwhelming to you, it’s important to call a credit repair company such as Nationwide Credit Clearing

Our Family of Experts is Ready To Get You Back To Healthy Credit

LET US HELP YOU SOLVE YOUR CREDIT TROUBLE (773) 862-7700

Nationwide Credit Clearing, the home of the Free Credit report and Consultation.

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

CLICK BELOW FOR YOUR…

Set yourself on the path to Financial Freedom: Mistakes can be corrected

We all make mistakes, especially regarding our credit and money management. Below you will find some ideas on how to rectify past financial sins you may or may not have made. It’s never too late.

Nobody’s flawless – especially when it comes to money management. There’s a pretty good chance that by now, you have control of your current finances, however, most of us have made some serious mistakes when we were younger. We have never had an owners manual on how to manage money, so chances are you have made some serious mistakes while you were younger or perhaps in college. Those previous mistakes can and will come back to haunt you today in many ways. Nationwide Credit Clearing recommends that you face your money issues head-on as well as make up for those wrong doings before being able to move on in the future..

LOOK WHAT’S GOING ON

When confronted with past financial faults, it’s easy to turn your head and hope that they disappear. But when you must pay back your money or fall behind on loans, creditors are still looking to get a way to get paid. This will definitely affect your ability, long term, to gain new credit and have financial freedom moving forward. Nationwide Credit Clearing recommends that you collect all of your records & go through them thoroughly, to allow yourself to see the bigger picture of which mistakes you have made and which ones can actually be corrected..

DEVISE A PLAN

As soon as you know where your situation stands as of now, it’s a great time to also create a plan to remove incorrect information from your credit report, as well as pay back past creditors. This is not going to be easy, but if it is important to you, we recommend that you make the time. Consider your plan as you would a project given to you at work. Focus on the plan, then look forward to the outcome.

START WITH THE BASICS

We don’t recommend that you use your savings to pay off old debt. Actually, starting with small debts – old credit cards for example – will allow you get rid of some of your smaller mistakes as well as help give you a sense of achievement. Start with the ones you can manage and control. This way, you’ll have leg room and information when it comes to time to repair your credit.

NEVER GIVE UP

Once you make progress on some of your little money issues, it will then be important to take the correct measures. The first thing you can and should do is get an accurate and up to date credit report. Nationwide Credit Clearing offers a service that provides anyone with an absolutely free, no credit card required credit report and consultation. Once we evaluate your current financial situation, we can then move forward and help you with a plan.

In conclusion, Now that you know more about how to rectify past financial sins, there’s no time like the present to get your free credit report and score.

Nationwide Credit Clearing

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

What impact do late payments have on your Credit Score?

Making late payments on your, mortgage, credit cards or loans will affect your overall credit health as well as hurt your credit score. Regardless of how late you pay, even one day late will count against you. Generally speaking, if your bills are not paid on or before the due date, this could affect you in the long haul.

Late Payments: How they Affect Your Credit

Banks as well as issuers consider the history of your payments especially after evaluating your overall credit risk & deciding if they should or should not approve you for the loan. A lengthy history of payments (on-time ) demonstrates that you are a reliable & responsible borrower.

However, a lengthy history of late payments will suggest that you are not qualified nor responsible to borrow money from a bank. The inability to be reliable is a huge red flag to banking institutions, and here are just a few things that can easily occur when you pay late.

- IT WILL END UP ON YOUR CREDIT REPORT

- INTEREST RATES WILL BE LIKELY TO RISE

- IT CAN DECREASE YOUR CREDIT SCORE

- YOU WILL END UP PAYING LATE FEES

Making late payments is a habit that could end in more damaging credit actions.

If you neglect an account until it is sent to collections or becomes delinquent, that will play a huge factor in your credit score drop. An account in collections may remain on your credit report for 7 years & cause more damage than a single late payment.

What to Do if You Have Late Payments on your Credit Report

A Simple Solution!

Credit Repair. Credit Repair is the process of identifying, disputing, and monitoring negative information on your credit report. Nationwide Credit Clearing has been helping people all over the US delete negative information from their credit past. Whether you have late payments, medical bills, or even bankruptcy, Nationwide Credit can help you get back to a state of healthy Credit.

Contact Nationwide Credit Clearing for your free credit report and consultation today.

Nationwide Credit Clearing

“HOME OF THE FREE CREDIT REPORT AND CONSULTATION”

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

http://mynationwidecredit.com/index.php/contact-us/

Department Stores Credit Cards. Good or Bad Idea?

This video explains why it’s important not to be fooled by department store discounts given to people just for opening up a new card. Todd Stern, founder of Nationwide Credit Clearing, explains “I do not advise people opening several credit cards just to get discounts”

Tips: if you do ask them if you can charge it on your main credit card which they WILL SAY YES.

Then wait a few days and call to cancel.

How to Score:

Get your 10% and be done. You don’t want to have several open credit cards it leads to nothing but confusion and possible late payments.

The Bottom Line:

Too many open cards will decrease your credit score and increase your debt.

Already have too many?

Contact Nationwide Credit Clearing for your free credit report and consultation today.

Nationwide Credit Clearing

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

http://mynationwidecredit.com/index.php/contact-us/

Can I get a Home Loan with Bad Credit?

The answer is: YES

To be quite honest, though, it’s not going to be easy to get a loan if:

- Your Credit Score is Low

- You Have Late Payments

- Derogatory Items on your Credit Report

- Excess Debt

- Anything else Related

Don’t get discouraged because there is a solution. Depending on your personal situation, it may take some work on your part to make your dreams happen, but for piece of mind, even if your credit is bad, the possibility of getting approved for a mortgage is there. You just have to take the correct steps and actions that will allow you to get approved. Below is some interesting information:

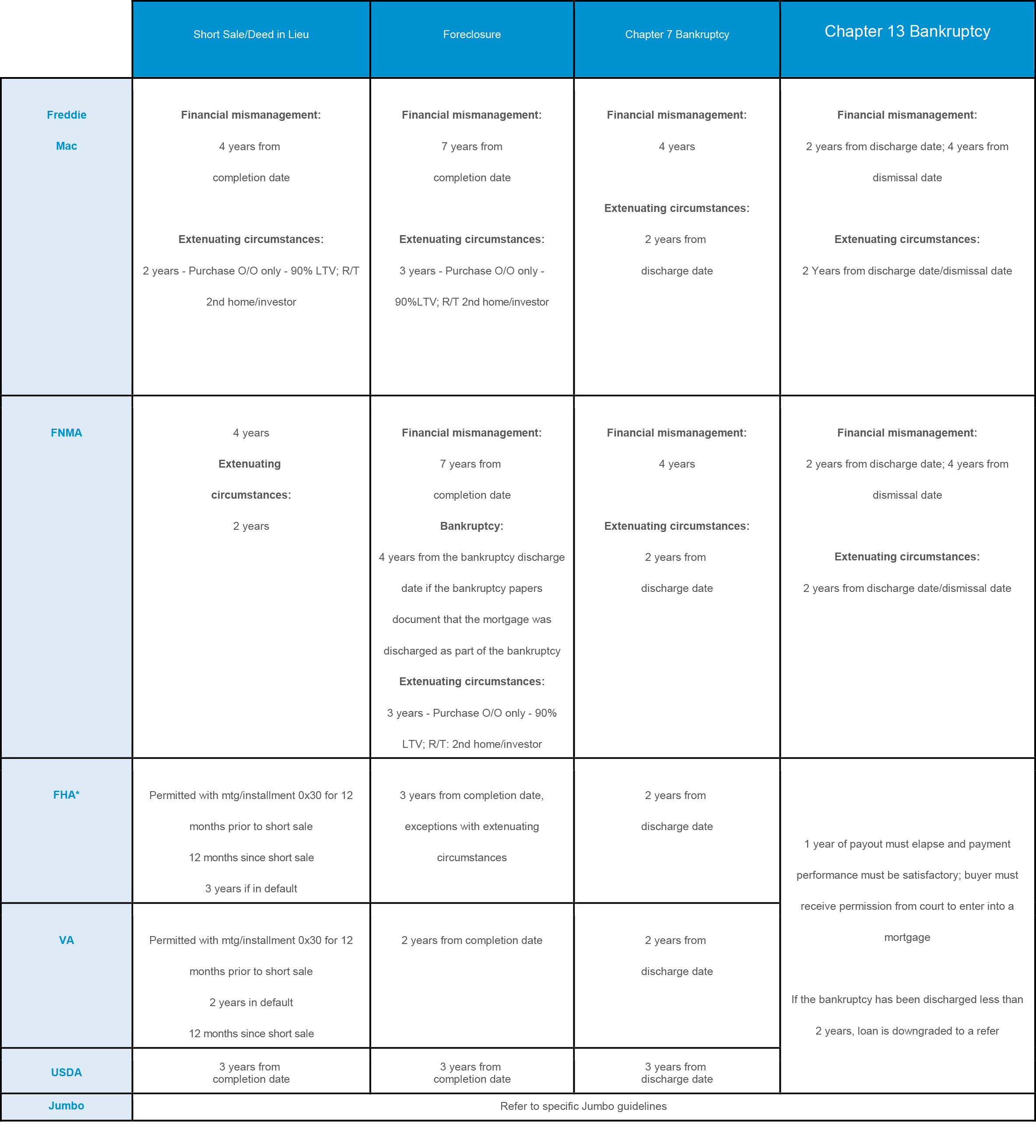

GUIDELINES FOR PEOPLE WHO HAVE CREDIT ISSUES BUT ARE TRYING TO GET A MORTGAGE:

If you have recently or in the past been denied for a mortgage, Nationwide Credit Clearing can help. We have been helping people remove negative items from credit reports for over 20 years. If a mortgage broker has a client that cannot get approved, often times they will send their client to Nationwide Credit Clearing, we will take the appropriate actions to help increase their client’s score, and send them right back through the approval process knowing that this time the end result will be different.

Just as well, if you are looking into getting a home loan, but are not in the process because you are afraid you may get denied, you will want to contact Nationwide Credit Clearing initially. We offer absolutely free no obligation credit report and consultations for all new or potential clients.

If you or someone you know is having a hard time getting approved for a home loan, contact us today.

After all, we are ” The home of the free Credit Report and Consultation”

Nationwide Credit Clearing

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

CLICK BELOW FOR YOUR…