-

Quick Contact

Get A free

Consultation Now!

Credit Report

Another 10 facts about credit scores, credit reporting, and debt.

Do you think you have a pretty good grasp of the topic of credit scoring? When it comes to credit reporting and scores, what we don’t know can hurt us!

Do you think you have a pretty good grasp of the topic of credit scoring? When it comes to credit reporting and scores, what we don’t know can hurt us!

That’s because your credit score impacts so much in your life these days, from rent and homeownership to credit card approvals, interest rates on student and auto loans to even employment. But too often, we’re still in the dark when it comes to credit scores, credit reporting, and general financial knowledge about debt management.

As the nation’s leader in credit repair solutions, Nationwide Credit Clearing is committed to helping educate you about these important topics. This is part three of our ongoing series as we count up to 50 things you didn’t know about credit score, credit reporting, and debt.

Look for part one and part two here and contact us if you have any questions or credit issues at all!

1. A survey by the Consumer Federation of America (CFA) discovered that the majority of consumers (just over 50%) had no clue that their credit scores can be checked and monitored by anyone other than credit bureaus. Only 53% of respondents knew that electric utilities checked credit scores and only 68% knew that home insurers, cell phone companies, and landlords regularly do the same.

2. However, even you may be shocked to hear that 90% of home and auto insurance companies check credit scores to help determine your coverage options and also what premiums you’ll pay.

3. A 2016 survey conducted by VantageScore found that only 32% of Americans (less than one-third) had received a copy of their free credit report within the last year, and 16% hadn’t even received a free report within the last three years.

4. Not to pick on college students, but they still have a lot to learn – about their classroom subjects as well as about credit scoring. In fact, a study by Equifax found that only 45% of college kids have any idea what their credit score is! It seems the majority of college students check their credit when applying for a credit card (41%), a new debit card or bank loan (33%) compared to only 4% who request and receive a paid copy.

5. Not only is credit score a crucial factor when you want to apply for a new loan or a mortgage, but employers are screening their potential employees for credit score like never before. It’s estimated that 1 in 4 unemployed Americans have been subjected to a credit score check when they applied for a job, and 1 in 10 has been denied a job because of a bad score or something on their credit report!

6. Adding to the credit score confusion, 45% of respondents think that age is a factor in credit scoring, and 38% believe marital status plays into their credit score. (Do they believe single or married people get a score bump?)

7. On the other end of the spectrum, about 26 million people – or 14% of the adult U.S. population – has no credit score at all, called “credit invisible.” Some of them are immigrants who haven’t had the chance to establish credit lines in the U.S., while others are from low-income or unstable environments and never have taken out a credit card or loan.

8. We all know the Big Four credit card companies now (Visa, MasterCard, Discover, and Amex), but the first ever credit card that allowed a member to purchase anything they’d like and then pay it back over time was called BankAmericard. Issued in 1958, they changed their name to the more-familiar “Visa” in 1977.

In 1966, the Interbank Card Association bought the rights to “Master Charge” from the California Bank Association, which they renamed “MasterCard” in 1979.

9. Americans may be buying new cars, homes, and fancy electronics, but how are we paying for everything? Too often, the answer is with debt. In fact, 52% of Americans spend more money than they earn every single month, and 21% have regular monthly bills that are more than their take-home pay! 1 in 4 Americans have more debt than savings, and the average American spends $1.33 for every dollar they earn.

10. The American Bankers Association found that 44% of Americans surveyed thought that credit scores and credit reports were the exact same thing! That’s probably why a study by the National Foundation for Credit Counseling (NFCC) revealed that a significant portion of consumers thought that they didn’t need to know their credit score because they already had a copy of their credit report.

Online fraud is one of the fastest growing forms of crime, reaching epidemic proportions in a nexus of technology and cruel anonymity that defies international borders. The highest instance of fraud attempts is now aimed at businesses, violating their often-weak or nonexistent firewalls to access customer financial data, and using it with impunity.

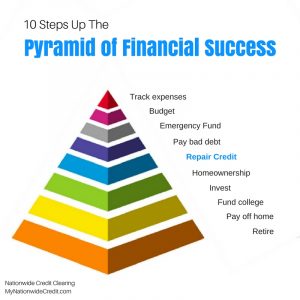

The Pyramid of Financial Success

The Pyramid of Financial Success

The Pyramid of Financial Success

No matter what our financial situations look like, everyone pretty much wants the same thing: low bills, plenty of savings, living in our own home, and enough investments to retire whenever we wish. Achieving that lofty goal is also very obtainable if you follow these 10 steps to climb the Pyramid of Financial Success:

1. Track expenses

Before you do anything else, it’s critical to know exactly how much you’re spending every month, and on what. Sure, you may THINK you know what your bills are and how much you spend, but I bet that you’ll be pretty shocked when you write down every single penny you spend (or use one of the great financial apps that help you record expenses). Try this for a month and then add up the total expenses and you’ll be amazed how much you’re blowing on impulse purchases, things you don’t really need or even want, and items that you didn’t realize are costing you!

2. Set a budget

Now that you know exactly what you’re spending your hard-earned dollars on, it’s time to tighten the belt. Ruthlessly slash everything from your budget that’s not a necessity – and hold yourself accountable to it. This will take some discipline but turn it into a fun game, and keep reminding yourself that by sacrificing NOW, you’ll be able to put yourself in a much better financial situation that lets you spend more on the things you really love and want later on.

3. Build an emergency fund

Did you know that 40 percent of Americans couldn’t come up with $400 in cash if faced with an emergency today, and two-thirds don’t have even $1,000 saved? As we’ve turned to debt more and more, the savings deficit in the U.S. has grown. However, it’s so important that you accumulate a rainy-day fund, which is a fair bit of cash that you can use when the car breaks down, you miss work because of a medical problem, or some other challenge. Start by putting $400 away, then $1,000, and keep saving until soon, you’ll have at least a few month’s total expenses saved as a cushion.

4. Pay debt

This is a big one! Once you’ve set a budget and put aside a few bucks as a safety net, it’s time to tackle the hardest part of all: paying off debt. In fact, the average American household now has $16,883 in credit card debt, $50,626 in student loans, $29,539 in auto loans, and, if they’re lucky, a mortgage on top of all that. But the one that we want to start with is paying off credit cards, as well as other revolving debt and retail installment loans. This is essential if you want to free yourself from a life of struggling and stressing about money and bills, and open up a much more secure and comfortable relationship with money.

There are several ways you can pay off your debt, but one of the best is using the technique of Debt Snowballing which is advocated by financial gurus Dave Ramsey, Suzie Orman and others. We’ll bring you more info on Debt Snowballing soon.

5. Repair credit

In fact, it’s a good idea to tackle #4 and #5 on this list in conjunction so that you’ll end up debt free AND with a fantastic credit score, starting with a free credit report and consultation from Nationwide Credit Clearing. We’ll go over your credit report and debt load with you, identifying which of them should be paid off first since they have the highest interest rates (or smallest balances).

Likewise, we can advise you which of your credit accounts should just be paid down (not off) and kept open. Our service will also attempt to remove negative, incorrect, and outdated items from your credit report, boosting your score to new heights.

How important is a great credit score? These days, just about everything you pay is tied to credit score, from all of your credit cards, your mortgage, and other loans, as well as utilities, cell phone accounts, the ability to rent a home, and even your job!

6. Buy a house

Speaking of (not) renting, once you have some savings and your debt paid off, the next big step in your financial pyramid is buying your own home. In fact, homeownership is still the American Dream, allowing you to build equity, pay down your loan, enjoy lucrative tax breaks, and experience the pride of ownership. These days, down payment programs make it easier than ever to come up with the money needed to buy a house, and you’ll essentially be paying yourself every month instead of your landlord!

7. Invest

Your bad debt is gone, and you’re now in your own home, so it’s time to start investing. Actually, you should be investing from day one in a 401K, mutual fund, or other safe, stable vehicle, as the power of compounding really comes into play the earlier you start. Contact a financial planner or advisor for the best way to invest and save for retirement considering your situation and goals.

8. Fund college

Remember how we mentioned that the average household has $50,000+ in student loan debt? Why not give your children a head start (not extra hurdles) in life by funding as much of their college education as possible instead of piling on more debt?

9. Pay off your home

We paid off your bad debt when we zeroed-out those credit cards, and you’ll get to a point high up the pyramid of financial success where the next logical step will be to pay off your home, too. There are several great strategies to help you do this, such as sending in a 13th payment every year, paying every two weeks instead of monthly, or adding extra funds to pay off principal faster. Either way, once you pay off your home in 20 or even 10 years instead of 30 (like most mortgages), your biggest bill will be knocked off the list.

10. Retire

With little or no debt, plenty of savings, a well-spring of investment income, and your home paid off, you’ll be in the enviable position at the top of the pyramid, where you can choose to retire whenever you like. Of course, that doesn’t mean that you must stop working, as many people opt to pursue their passion or work a lighter schedule just because it’s enjoyable. Either way, you’ll be the master of your financial life – not the other way around! Congratulations on making it to the top of the pyramid!

10 More things you didn’t know about credit scores, credit reporting, and debt in America

Your credit score impacts so much in your life these days, from rent and homeownership to credit card approvals, interest rates on student and auto loans to even employment. But too often, we’re still in the dark when it comes to credit scores, credit reporting, and general financial knowledge about debt management.

Your credit score impacts so much in your life these days, from rent and homeownership to credit card approvals, interest rates on student and auto loans to even employment. But too often, we’re still in the dark when it comes to credit scores, credit reporting, and general financial knowledge about debt management.

As the nation’s leader in credit repair solutions, Nationwide Credit Clearing is committed to help educate you about these important topics. This is part two of our ongoing series, 50 things you didn’t know about credit score, credit reporting, and debt. Look for part one here, and contact us if you have any questions or credit issues at all!

1. Which company earns the title as the most popular credit card in the rest of the world? That honor belongs to both Mastercard, which has 551 million cards issued throughout the world as well as 180 million cards here in the United States. However, Visa wins top-dog honors on home soil, with 278 million cards floating around the U.S., as well as 522 in the rest of the world.

2. It’s no surprise that people often turn to their credit cards to pay bills and living expenses once they are unemployed, In fact, 86 percent of low and middle-income households who have a working member that is now unemployed turn to credit cards to fill the gaps monthly.

3. Likewise, almost 50 percent of low and middle-income households now are carrying credit card debt that comes from out of pocket payments they have to make on medical bills and expenses.

4. It’s interesting to look at a map and compute the average credit score for each state (OK, I don’t get out much!). In fact, the states with the lowest average credit scores are in the south and southwest, including New Mexico, Texas, Oklahoma, Arkansas, Louisiana, Mississippi, Tennessee, Georgia, Alabama, South Carolina, Nevada, and Florida. In those states, an alarming 40 percent of the population have subprime credit scores!

5. However, the states with the highest average credit scores are found in the north and midwest. Minnesota and North Dakota are the states with the highest average credit scores, with 707 and 700 average FICOs, respectively.

6. Aside from the state you live in, there are some other puzzling correlations between the heights of your credit score and your seemingly unrelated behaviors. For example, one study found a direct correlation between credit scores and which email provider the participants used! They found that Comcast email user (692 average) and Gmail, (682) have above average scores, but MSN (669), Aol (668) and Yahoo! (652) email users have below average scores.

7. But more common-sense correlations also apply. For instance, there are significant differences in credit scores based on age. Baby Boomers and the Silent Generation (68-85 years old) have average scores of 700 and up, while Gen Xers average a 655 score, Millennials average a 634 score, and Gen Z is lagging with a 631 average Vantage Score.

8. One correlation that we could have easily predicted is that between scores and homeownership, In fact, a Federal Reserve study found that the average credit score among homebuyers and homeowners is 728 – significantly higher than the national average. Additionally, they found that only 6.8% of homebuyers or homeowners had scores below 620 in the study.

9. We hear about our credit scores impacting home ownership, credit cards, interest rates on other loans, renting, and even employment. But did you know that your credit score can make a big difference on…your dating life? It’s true! According to a 2016 Bankrate survey, almost 4 in 10 U.S. adults say that they’d rather date someone with a good or excellent credit score, but they’d be wary of dating a sup-prime suitor. In fact, 43% of women and 32% of men said that a person’s credit would have an impact on if they dated them.

10. Americans are still pretty mixed up, confused, and turned around when it comes to basic knowledge of credit scores and credit reporting. In fact, studies have shown that of an average sample Americans, 47% didn’t know that credit scores are used by non-creditors like electric utilities and home insurers, 68% didn’t know that cell phone companies use credit scores, and 32% had no idea that landlords could check their credit!

***

Do you have questions about your credit or looking to improve your score? Contact Nationwide Credit Clearing for a FREE credit report and consultation at (773) 862-7700 or mynationwidecredit.com!

5 Ways to jump-start your credit score.

Is your credit score far less than ideal these days? If your FICO is lagging, just like about 30 percent of all Americans, it may be holding you back from getting a better credit card, applying for a mortgage loan to buy a house or even being hired for your dream job.

Is your credit score far less than ideal these days? If your FICO is lagging, just like about 30 percent of all Americans, it may be holding you back from getting a better credit card, applying for a mortgage loan to buy a house or even being hired for your dream job.

But the good news is that there are strategies you can use to build your credit, raising it to the point that you are considered a prime candidate for the best interest rates and credit approvals from banks, lenders, and other financial institutions.

Some of these strategies are part of a long-term plan to maintain good credit, but we also have ways to almost instantly boost your score.

If you are planning to apply for a home mortgage, finance a new car, or try to get a job that checks credit as part of the hiring process (like about 45 percent of all employers these days), you’ll want to utilize these five tactics.

Remember that Nationwide Credit Clearing is the U.S. leader in fast, effective, and affordable credit repair, so call us if you’d like a free credit report and consultation to get started!

- Pay down balances.

We know that the ratio of your debt to total available credit – called credit utilization ratio – makes up about 30 percent of your credit score. Therefore, people with maxed out credit cards or high debt loads compared to their available credit will see their scores steadily sinking.

So, the first thing you want to do when improving your credit score is to pay down as much debt as possible.

It’s important to get your credit utilization ratio below 30 percent (so you only owe $3,000 or less on a credit card with a $10,000 available balance). Credit experts even suggest keeping a utilization ratio of 10% or less to achieve a great credit score. However, don’t go all the way to 0% because it won’t show an established payment history they can use in their calculations (since you won’t have any payment).

- Request a credit line increase.

Don’t have enough money sitting around to pay down your credit balances enough to raise your scores? Another sneaky-good way to improve your credit utilization ratio – without paying down one cent of debt – is to increase your total available credit. For instance, let’s say you had a $10,000 credit line but owed $4,000 (so your utilization ratio was 40 percent).

Instead of paying down your debt, if you could get the credit card company to increase your available limit to $15,000 from 10k, your utilization ratio just went down to about 27 percent – and your score would go up! To do this, simply call the credit card company or lender and make your case over the phone and they’ll either approve or deny your request or approve a lesser increase.

- Ask your creditors to remove late payments from your credit report

Did you know that you can simply ask your creditors to remove evidence of late payments from your credit report? Why not? It’s free for you to ask (nicely), and the worst thing they can say is “no.” Called ‘Goodwill late-payment removal,’ this practice is more common than you may think. In fact, any creditor has the power to remove a late payment from your credit report.

For instance, department store credit accounts and other retail accounts are usually pretty liberal with goodwill late-payment removals. They may do just that if you can make a good case that it was a one-time incident because you didn’t receive the bill on time, an address change, etc. and that you otherwise have a perfect record with them.

Once they tell you that the late payment is removed, ask for payment history update letter, which is your confirmation in case you need to present documentation to the credit bureaus.

- Pay for deletion of collections

Many of us have collections on our credit reports, which can do some serious and ongoing damage to your score But there may be a way to get it removed. If you’ve missed enough payments to have an account in collections, your creditors may agree to erase any negative credit reporting for that account if you pay it off.

The good news is that you can also negotiate your payoff, and if it’s in collections, they may accept less than the full amount to settle you up – sometimes even 50 percent of your balance or far less!

Once you negotiate the payoff amount AND they agree to remove the item from your credit report, only pay the collection via a mailed certified check, with “Cash only if you delete account from credit report” written above the endorsement line. Also, make sure you get their promise in writing via a letter of deletion. We can use the letter to apply for a rapid rescore instead for you, so you won’t have to wait a month or more to see your credit score rise!

- Dispute any errors on your credit report.

Most people don’t realize that credit reports often contain mistakes, misreporting, duplicate items, or outdated information. All of these things may be lowering your score, but they can also be removed. Start by contacting Nationwide Credit Clearing for a copy of your credit report, and we’ll help you review it carefully for any errors or inaccuracies.

By reviewing it line-by-line, we’ll be able to highlight inaccuracies or items that are lowering your score. Remember that there are three major credit bureaus and they each may report different information, so it might be a good idea to check all three. Look for errors on larger accounts first, length of history, payments reporting on time, and that your balances are accurate.

The last step is formally disputing each inaccuracy or error with each of the credit bureaus, Equifax, Experian, and TransUnion, separately. They are legally obligated to get back to you in a certain amount of time with proof that the information you’re disputing is correct – or they have to change it or remove it.

***

If you have more questions about disputing items, how to boost your score quickly, or want a free copy of your credit report, contact Nationwide Credit Clearing!

.

Can your credit score go down because of your social media activity?

Like it or not, social media is a big part of our lives. In fact, 81% of Americans have at least one social media profile, and we now use 2,675,700 GB of Internet data per minute! Twitter, Instagram, Snapchat, LinkedIn, and YouTube are popular social media platforms, but Facebook is still the biggest, with more than 2 billion users worldwide.

Like it or not, social media is a big part of our lives. In fact, 81% of Americans have at least one social media profile, and we now use 2,675,700 GB of Internet data per minute! Twitter, Instagram, Snapchat, LinkedIn, and YouTube are popular social media platforms, but Facebook is still the biggest, with more than 2 billion users worldwide.

People post just about every detail of their lives these days, share droves of links and content from others, and reach far past their circle of friends that they know in real life.

But it might not just be other social media users who are watching your Facebook and social media accounts and judging you. In fact, banks, lenders, and credit bureaus may soon be paying attention to your social media usage – denying you for a loan or lowering your score based on what they see.

Already, the scope that our personal data from social media is collected, shared, and sold is startling. Pretty soon, you might be denied for a loan on a credit card, a car, or even a mortgage because of who you’re friends with on Facebook. For instance, the average credit score of your social media friends and network could be a factor that influences your credit worthiness, too – a scary proposition. It’s not as far-fetched as you may think.

Back in the “good old days,” lending in the U.S. usually took place on a more personal level, with consumers walking into the local branch of their hometown bank. They sat down with a banker whom they already knew a long time and made their case for approving the loan during a conversation, with the bank granting or denying their request based on their character and reputation.

We’ve come a long way since then, and now, lending decisions are made uniformly with mountains of data collected and interpreted by nameless, faceless credit agencies with advanced algorithms – the credit bureaus.

But even with all of our advanced technology, some things never change, as credit bureaus and lenders may well be turning back the clock and trying to gauge your character, lifestyle, and reputation before approving you for a loan. Not only can they look at what you post, but check-ins, what content you like and share, and even the groups or brand pages you belong to.

The U.S. Patent office recently granted an updated patent on technology that combs social media for evidence of a person’s closest network of friends. It then relays that information to potential creditors, who can make lending decisions based on the friends’ perceived financial stability.

The patent, which Facebook first acquired from Friendster and inventor Christopher Lunt in 2010, actually has a much broader scope of intended use than just data mining for lenders. In fact, the main purpose of the patent is to protect technology that formulates and tracks how social media users are connected in a social network, protecting them from spam

But another use in the patent’s official application (called use cases in patent-speak) definitely outlines that same technology functioning as a way for lenders to aggregate credit scores and financial data from your Facebook friends when you apply for a loan.

All of this can eventually factor into their complex algorithms that gauge you as a solid candidate for a new loan – or a big credit risk.

However, there are several reasons why credit risk monitoring via social media may not be practical, ethical, or even legal.

First off, we have the Equal Credit Opportunity Act, a federal law that states that credit must be granted to all creditworthy applicants without paying credence to their race, religion, gender, marital status, age and other personal characteristics. That’s the exact reason you aren’t asked your race, religion, etc. on any loan application or credit form. But that information is often readily available on many Facebook and social media profiles, which opens the door for discriminatory practices.

Next, credit decisions are all supposed to be transparent and disputable. That means you’re supposed to know why your score goes up and down, and there can’t be mysterious or secret factors that play into your score that are disclosed on your credit report. Likewise, you have the right and ability to dispute incorrect items on your credit such as duplicate items, bad information, or even accounts opened and used by ID thieves.

But when credit bureaus track and use your social media usage to help determine your credit worthiness, they’re using factors that are neither transparent or disputable.

Furthermore, pundits point out that social media accounts can be easily manipulated. For instance, if a social media user knows that creditors are watching, they might purposely post certain things, like certain brands, check-in at certain places, etc. that would reflect positively upon them in the eyes of creditors. Basically, they could also set up fake or duplicate social media accounts, or you have the risk of someone else setting up a social media profile in another real person’s name.

Lenders will always look for “alternative data” to improve the accuracy of their credit lending decisions, some things. Cell phone usage, paying rent on time, and even bank account activity could possibly impact your credit score shortly.

But the potential for creditors to track your social media usage raises some serious concerns.

Can you achieve a perfect credit score? We’ll show you how!

When you get together with your friends, family, and coworkers, there’s always one person who loves to brag about how well they’re doing. It may be about their new car, high-paying job, or even the amazingly low interest rate they just got on their mortgage.

When you get together with your friends, family, and coworkers, there’s always one person who loves to brag about how well they’re doing. It may be about their new car, high-paying job, or even the amazingly low interest rate they just got on their mortgage.

So wouldn’t it be great if the next time they opened their mouth to be braggadocious, you could one-up them by reporting that you had a perfect credit score? There’s no topping that!

But there are plenty of financial benefits to a perfect (or excellent) credit score, too.

FICO, the most popular credit scoring model, issued by the Fair Isaac Corporation, ranges from 300 all the way up to 850. Generally, a score above 680 or so is considered “good,” and once you hit the 720 to 740 range, your score is considered “excellent.”

But there’s another level or two above that for consumers to strive for. In fact, 32.8 million people have FICO scores between 700 and 749, but approximately 70 million consumers have FICOs above 760.

Don’t stop there, because it’s possible to raise your credit score even higher. An estimated 36.4 million people have scores between 750 and 799, and 38.6 million are in the 800+ FICO range.

Only about 1% of consumers, around 2 million people, ever reach high-end 800-850 scores.

In fact, FICO estimates that only about .5% (half of one percent) of all consumers with a credit score have a perfect 850 FICO. To put in in context, the average FICO score in the United States has just reached 700 for the first time.

Remember that FICO isn’t the only credit scoring model, as there are dozens of other scoring models that banks and lenders use to make lending decisions, and then different versions of each depending on what kind of loan or even consumer they’re vetting.

So let’s say you reach an 800 credit score, or even an enviable 850 – a perfect credit score. Beyond bragging to your friends, what are the benefits?

An 850 credit score may not help as much as you think IF you compare that to another great score, like an 800, 780, or even lower. That’s because FICO uses algorithms that rate scores within “brackets,” which means that if you have above 750 or maybe 780, there really won’t be an additional benefit the higher you go.

“It’s important to understand,” reports FICO spokesman Anthony Sprauve, “that if you have a FICO score above 760, you’re going to be getting the best rates and opportunities.”

For instance, a consumer with an 850 FICO will most likely be offered the same mortgage interest rate, auto loan rate, or 0% interest credit card offer as another consumer that “only” has a 780 score.

While you may expect little perks, additional beneficial terms, and premium services with a perfect credit score, you most likely won’t see any huge benefit once you reach the “super-prime” scoring bracket.

So why strive for a perfect score? Remember that credit scores are dynamic, constantly going up and down, so today’s perfect score may be a little less next month. Furthermore, it certainly doesn’t hurt to aim for a perfect score and still have an excellent FICO even if you fall a little short. And since your credit score is a good indicator of your financial acumen and dealings with debt, a perfect credit score most likely means that your financial house is well in order.

Whether you want a perfect credit score – or just trying to improve your score until you reach 700 or even 800 – here are ten important strategies:

- Pay on time (and never miss a payment)

Even one late payment can hurt your score, and paying on time is about 35% of how FICO calculates your score. In fact, 96% of people with a FICO score of 785 or greater have no late payments on their credit reports.

- Pay down your balances

Your credit utilization ratio – how much debt you keep compared to total available balances – makes up about 30% of your credit score calculation. While you commonly hear that you should pay your credit cards and debt down below 30% of the available balances, to shoot for that perfect credit score, you’ll want to pay then down to 10% or below. In fact, a survey of consumers with 800+ scores revealed that their average credit utilization rate was just 7%.)

- Keep older and seasoned accounts

About 15% of your credit score is calculated by the length of your accounts, so older is better. According to FICO research, the average credit super scorer has an account that’s 19 years old. Likewise, the average age of their accounts is between 6 and 12 years, and they opened their most recent account 27 months ago or more.

- Keep a good mix of credit

10% of your credit score depends on managing a healthy mix of credit, including mortgages, installment loans, and high-quality revolving accounts. Consumers with FICO scores 760 and up have an average of six accounts that are currently “paid as agreed,” and an average of three accounts with a balance.

- Shop around in clusters

When you have your credit pulled to “shop around” for a loan, make sure it’s within a 30-day window and FICO won’t factor those pulls into your score. Even if they are spread out within 45 days, they’ll only be treated as one credit inquiry.

- Check your credit report often

About 25% of all credit reports contain errors, and ID theft and fraud affect about 1 in 8 American consumers. So to achieve a great score, check your score frequently and consider a credit monitoring service.

- Make payments before the due date

To earn an 800+ credit score, make payments well before you receive your bill and the due date. Try paying off (or down) your purchases at the end of every week for the best credit score.

- Increase your credit limit when offered

Another way to improve your credit utilization rate and boost your score is to take advantage of any offers to increase your credit line.

- Stick to one or two good credit cards

It’s best if you only use one or two cards on a regular basis. American Express is a great choice, as the balances don’t report to FICO since you pay them off in full every month.

- Improve your score with Nationwide Credit Clearing!

We’re the trusted leader in credit repair done right. Contact us at (773) 862-7700 or MyNationWideCredit.com for a free report and consultation so we can get you started on the way to a perfect credit score!

How Can A Bad Credit Score Affect You?

When you make a purchase using your credit card, you are typically not thinking about the affect it will have on your future. You probably aren’t thinking of the purchase as a test of your personal integrity or reliability. You are more than likely thinking about that new television you are purchasing or how your new watch will look on your wrist. In contrast, your creditors don’t care how your new watch will look or how much joy your new television will bring you. They want to recover the money they lent you, with interest. Lenders do not like borrowers with elevated credit risk (the risk that you will not repay the money you owe). To determine your credit risk, lenders will rely on your credit score.

Your credit score is based on the information that is provided in your credit report. It will include data on past loans, foreclosures, credit utilization, bankruptcies, credit applications, and more. Credit scores follow a scale ranging from 300 (most risky) to 850 (least risky). Lenders will often times segment the score ranges into classifications such as A, B, and C.

Your credit score will affect more than just your personal finances. Credit scores influence many aspects of your personal and public life, even including situations that do not involve borrowing money. The following are situations that can be affected by a bad credit score:

- Getting approved for a loan will be difficult

- Higher rates and restrictive terms on loans that you are approved for

- Trouble renting an apartment

- Trouble getting a job

- Difficulty getting a mobile phone contract

- Higher insurance premiums

- Potential strain on your personal relationships with friends and family

Here at Nationwide Credit Clearing we will professionally assess your credit situation by procuring basic information that will allow us to obtain a copy of your current credit report. We will do this by a “soft inquiry” so that it will not affect your credit score. Our team of professionals will determine the best method of credit clearing to utilize on your case. Learn more about how we can help you!

Source: Money Crashers

“Home of the Free Credit Report & Consultation”

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

follow us on…

What Is A Credit Report?

An extremely detailed report of a person’s credit history, that is prepared by a credit bureau, is what makes up a Credit Report. The report is typically used by a lender in determining a loan applicant’s creditworthiness, including the following:

- Summary of credit history

- Detailed account information

- Personal data

- Credit history

- Details of any accounts turned over to a credit agency

The information includes how often you make your payments are made on time, how much credit you have, how much credit you are using, and whether a debt or bill collector is collecting on money you owe. It can contain public records such as judgements, liens, collections & bankruptcies that provide insight into your financial status.

How Does A Lender Use A Credit Report?

Lenders will obtain your credit card when you are deciding if they want to loan you money. They will also use it to determine what interest rates they will give you and to determine whether you will be able to meet the terms of the account they are providing. Other kinds of companies such cable, insurance, utilities etc. will always run a check to make sure you will be able to meet the financial terms of the program/service you are requesting. Additionally, an individual or company that is renting you a residential property can check your credit report before renting to you.

Who Makes A Credit Report?

Credit reporting companies, known as credit bureaus or consumer reporting agencies, create credit reports. The major bureaus in the U.S are Experian, Equifax and Transunion. There are also specialty consumer reporting agencies that can report your history of paying bills for a product or service.

How Nationwide Credit Clearing Can Help You

At Nationwide Credit Clearing we professionally assess your individual credit situation by procuring information that allows us to obtain a copy of your credit report. Our staff of professionals will review the information and determine the best method of credit repair to use based on your specific situation. Our long standing reputation working with credit bureaus goes back as far as 1985. NCC works with all three major Credit Bureaus:

If you or someone you know has something on their credit report that continues to hold them back from living a financially full-filling life, it’s time to call the Credit repair experts at Nationwide Credit Clearing

“Home of the Free Credit Report & Consultation”

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

Find us on …

Credit Card Best Practices

Whether you are opening your first credit card or need a refresher, these credit card best practices are essential to maintaining a healthy credit score. While you may think you have your credit cards under control, there may be a few items on this list that can help you to improve.

Here’s the Rundown..

Look For A Low Interest Rate: When you are on the market for a new credit card, be sure to check the interest rate and annual fee. Read the cardholder agreement! It will give you insight into all the fees you can be charged. Don’t be afraid to ask questions before opening a new card.

Don’t Spend More Than You Can Afford: Don’t buy a TV that costs as much as your credit limit, just because you can. Purchase what you can afford to pay off at the end of that month. This will enable you to avoid interest fees.

Pay On Time: Show lenders you’re reliable, pay your credit card on time! You don’t want to pay that late fee. Also, be sure to check when your payment is due each month, it can change from time to time

Pay Off As Much As You Can: At the very least pay the minimum balance. Pay off the entire balance whenever you can, to reduce the finance charges you pay. As a rule of thumb, pay off as much as you can to avoid high interest payments. When you do have to keep a balance on your credit card try to keep it below 30% or less.

Avoid Cash Advances: When you choose to do a cash advance, a fee and interest rate is typically part of the deal. Interest rates for cash advances tend to be much higher. Only do a cash advance if it is an emergency.

Stay Within Your Limit: Keep track of what you are purchasing each month. If you stay within your limit, you’ll avoid over limit fees. Keep your credit card balance below 70% of your limit at all times. This shows lenders that you have control over how much credit you use.

Use Your Credit Card Regularly: Use your credit card regularly with the mindset that you will pay it off at the end of the month. This will show lenders that you have a proven history with being able to handle your money responsibly.

If you have tried time and time again to put these steps into play in your daily life but can’t seem to get anywhere, there is help.

Don’t wait! Better Credit is just a click away! Call the experts at Nationwide Credit Clearing. “Home of the Free Credit Report and Consultation”

Nationwide Credit Clearing

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

Follow us …

Your Credit Score: What is NOT factored in?

The general population doesn’t know enough about Credit in general to be able to determine what exactly is and is not factored into your overall credit score. Nationwide Credit Clearing has compiled a list of these factors for you to review on your own. This is good information for everyone to understand.

Federal laws including The Consumer Credit Protection Act and the Equal Credit Opportunity Act prohibit some things from being factored into overall credit scores.

These things include:

- Religion, Color, Race, Sex, national origin, & marital status. In Fact, US law prohibits credit scoring from even considering any of the above factors. Just as well, any receipt of public assistance, or the exercise of consumer rights under the Consumer Credit Protection Act.

- Your age cannot be factored into your credit score

- Your employer, occupation, salary, title, employer name, as well as date employed or any of your employment history. Lenders can consider this information for certain purposes, but it is not used in the credit scoring process

- The state, city, or address of where you live

- The interest rates you are being charged on any of your current credit cards or loans

- Rental agreements.

- Anything reported as child and/or family support obligations

- Any type of information that is not found in your credit report.

- If information is not proven to be predictive of future credit performance, it will not be factored in

- Certain types of inquiries such as:

- “consumer-initiated” inquiries — requests you may have made for your credit report while simply checking your score

- “promotional inquiries” –- requests made by lenders in order to make you a “pre-approved” credit offer

- “administrative inquiries” – requests made by lenders to review your account with them.

- Requests that come directly from Employers

If you or someone you know is having trouble with their credit, and needs some guidance on how to increase a credit score, Nationwide Credit Clearing can assist you.

Stop letting bad credit affect your finances! At Nationwide Credit Clearing, We help you work on your credit report and dispute unfavorable or inaccurate/outdated information. In Turn, this it will help to improve your credit score and ultimately allow you reach your future financial goals.

Don’t wait! Better Credit is just a click away! Call the experts at Nationwide Credit Clearing. “Home of the Free Credit Report and Consultation”

Nationwide Credit Clearing

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

http://mynationwidecredit.com