-

Get A free

Consultation Now!

Tag Archives: transunion

What Is A Credit Report?

An extremely detailed report of a person’s credit history, that is prepared by a credit bureau, is what makes up a Credit Report. The report is typically used by a lender in determining a loan applicant’s creditworthiness, including the following:

- Summary of credit history

- Detailed account information

- Personal data

- Credit history

- Details of any accounts turned over to a credit agency

The information includes how often you make your payments are made on time, how much credit you have, how much credit you are using, and whether a debt or bill collector is collecting on money you owe. It can contain public records such as judgements, liens, collections & bankruptcies that provide insight into your financial status.

How Does A Lender Use A Credit Report?

Lenders will obtain your credit card when you are deciding if they want to loan you money. They will also use it to determine what interest rates they will give you and to determine whether you will be able to meet the terms of the account they are providing. Other kinds of companies such cable, insurance, utilities etc. will always run a check to make sure you will be able to meet the financial terms of the program/service you are requesting. Additionally, an individual or company that is renting you a residential property can check your credit report before renting to you.

Who Makes A Credit Report?

Credit reporting companies, known as credit bureaus or consumer reporting agencies, create credit reports. The major bureaus in the U.S are Experian, Equifax and Transunion. There are also specialty consumer reporting agencies that can report your history of paying bills for a product or service.

How Nationwide Credit Clearing Can Help You

At Nationwide Credit Clearing we professionally assess your individual credit situation by procuring information that allows us to obtain a copy of your credit report. Our staff of professionals will review the information and determine the best method of credit repair to use based on your specific situation. Our long standing reputation working with credit bureaus goes back as far as 1985. NCC works with all three major Credit Bureaus:

If you or someone you know has something on their credit report that continues to hold them back from living a financially full-filling life, it’s time to call the Credit repair experts at Nationwide Credit Clearing

“Home of the Free Credit Report & Consultation”

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

Find us on …

Lower credit score?

How is it that you can actually get a lower credit score when you feel like your spending habits have gotten better? Learn why your credit scores might have dropped since you last checked them by using this informative infographic below:

In summary, here are 5 solid reasons your credit score may have recently dropped:

1. 30 plus days late on payments

2. Credit Card balances exceed 30% total

3. Closing an old account

4. Too many Credit Card Inquiries

5. Identity Theft may have racked up debt without you knowing.

If this seems overwhelming to you, it’s important to call a credit repair company such as Nationwide Credit Clearing

Our Family of Experts is Ready To Get You Back To Healthy Credit

LET US HELP YOU SOLVE YOUR CREDIT TROUBLE (773) 862-7700

Nationwide Credit Clearing, the home of the Free Credit report and Consultation.

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

CLICK BELOW FOR YOUR…

Why Is My Overall Credit Score Important?

What Is A Credit Score?

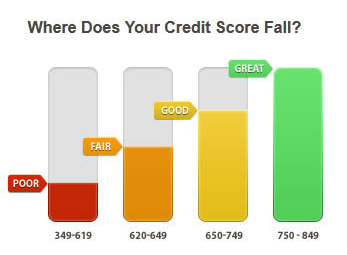

A credit score is a three-digit number, typically between 300 to 850, which credit bureaus calculate based on information in your credit report. It is a simple, numeric expression of your credit worthiness. Although the three credit reporting bureaus (Equifax, Experian, and Trans Union), use similar methods to determine a credit score, the formulas they use are not exactly the same and your credit score will vary from bureau to bureau.

How is My Overall Credit Score Calculated?

Your credit score is calculated based on a number of factors listed in your credit history that describe components of your financial life including the number and type of credit accounts you have, the amount of available credit, the length of your credit history and your payment history. Each of these factors is assigned a numerical value, and then weighted based on how prominently they affect your credit worthiness.

How Do My Actions Impact My Score?

The good news is that no matter where your credit score is today, there are a number of different steps you can take now that can change your credit history and help impact your credit score. You should take all the steps you can to help establish a good credit score.

Why Should I Check my Credit History and Overall Credit Score?

In today’s digital economy, your credit history and credit score are vital pieces of information that are key to helping you secure your financial life. Credit card companies, mortgage lenders, and insurance companies will pull copies of your credit report and score in order to decide whether to extend credit or how much to charge for your insurance premium.

Financial services companies tend to group borrowers into segments according to their credit score. These credit score ranges may determine how much you’ll be charged for your insurance coverage or the interest rate you pay on your mortgage, student or car loan or the type of credit card you’ll be offered.

If you haven’t checked your score lately, or have interest in improving your overall credit score, contact Nationwide Credit Clearing.

We offer Free (no credit card required) consultations after we pull your free credit report. Contact us Today!!

X-5 Credit Repair System

New X5 Credit Repair is the newest software that has been rolled out by Nationwide Credit Clearing. This software is the most cutting edge on the market today. once you become a client, you will be able to login to your account online to view the status as well as send email updates frequently regarding the status of your deleted items.

Along with that, everytime your file is updated, you will receive a text message regarding the changes.

On another note, if you just happen to be a mortgage broker and you refer a client to Nationwide Credit, you will automatically become an agent so you can check on the status of potential clients credit reports and deletions.

Remember, Nationwide Credit Clearing is the #1 Credit Repair company in the industry, providing you with the ultimate in credit repair technology… contact us today for your FREE credit report and consultation.

Nationwide Credit Clearing

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

Credit Repair Results – A Case Study

Nationwide Credit Clearing has been in the credit repair business for 28 years and we have helped thousands of people eliminate deragatory items from their credit report. We handle all of the work for the clients from start to finish. We give the client a free credit report consultation on day one. For us. however, It’s not just about signing up clients- we want to help them reach their goals. We Care! This is how much we care….

Here is an example of a client we have been working with more recently, and you can see by the data below… WE GET OUR CLIENTS RESULTS…

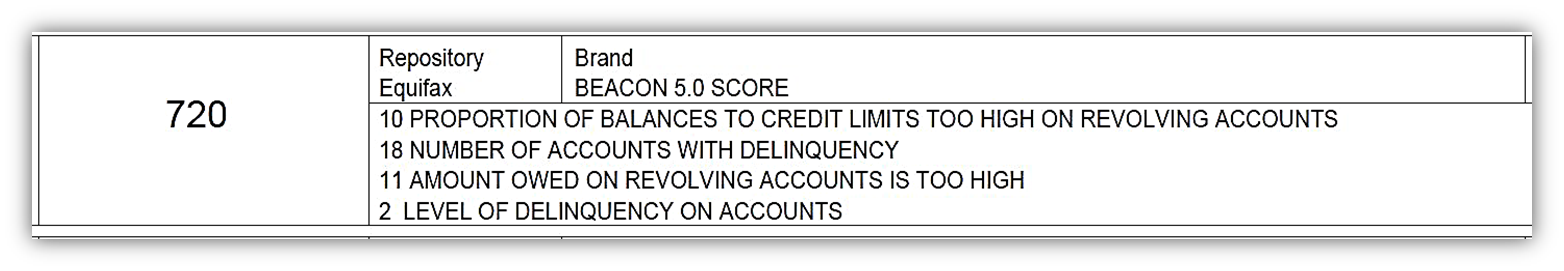

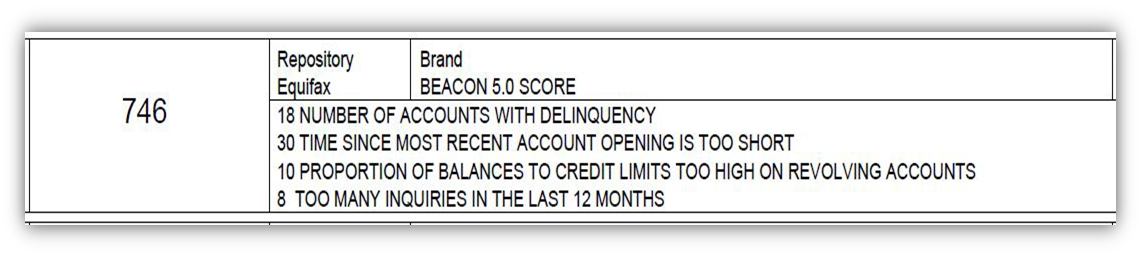

EQUIFAX: Score increase 26 Points from 720 to 746

Before:

After:

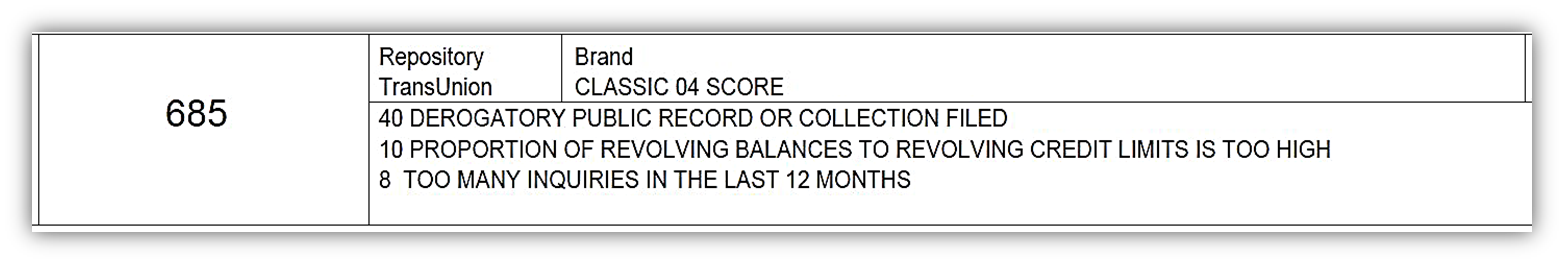

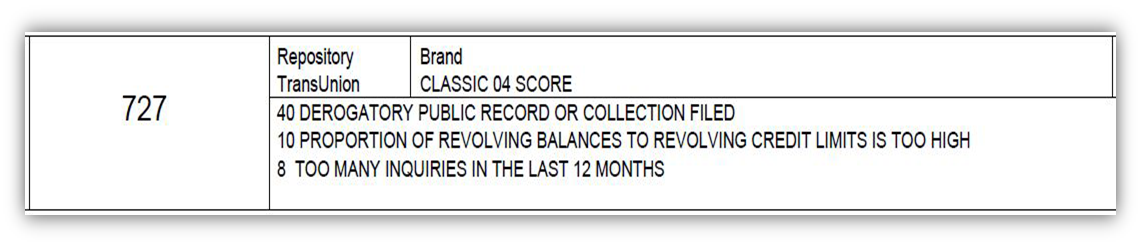

TRANSUNION: Score increase 42 Points from 685 to 727

Before:

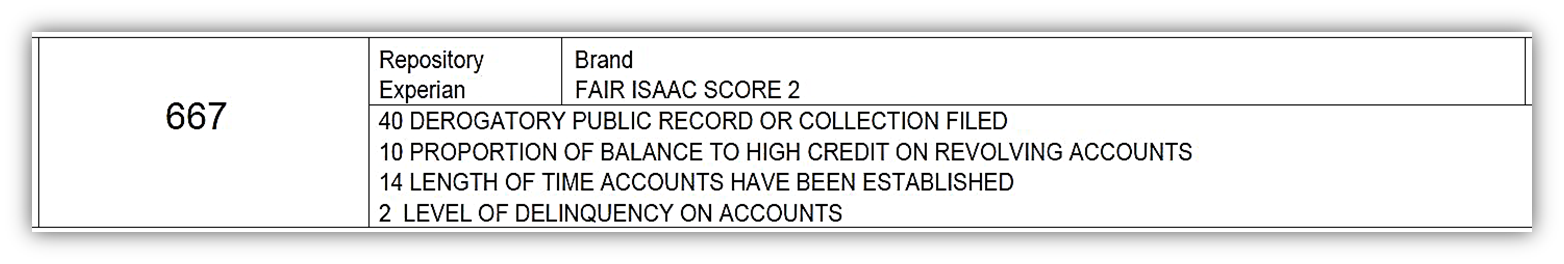

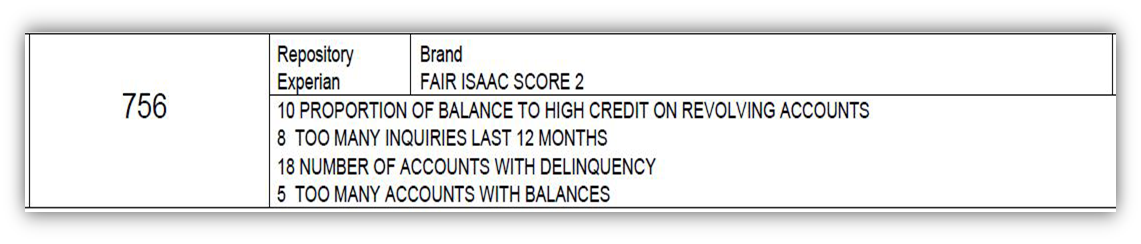

EXPERIAN: Score increase 89 Points from 667 to 756

Before:

After:

As you can see, we take your credit matters personally, and if we don’t get you results, we are not satisfied. If your new years resolution involves managing your money or increasing your credit score so that you can ultimately live a more fullfilling life, then you came to the right place.

As you can see, we take your credit matters personally, and if we don’t get you results, we are not satisfied. If your new years resolution involves managing your money or increasing your credit score so that you can ultimately live a more fullfilling life, then you came to the right place.

What are you waiting for? Click HERE to get your FREE (no credit card required) Credit Report and Consultation…

Nationwide Credit Clearing

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

How long does information stay on my Credit Report and how can Credit Repair help me?

This is a great topic because it is one of Most Frequently Asked Questions to credit repair companies by those who are trying to improve their overall credit score. The answer is probably not what you are looking for if you are someone who has had significant late payments, judgements, bankruptcy or other

This is a great topic because it is one of Most Frequently Asked Questions to credit repair companies by those who are trying to improve their overall credit score. The answer is probably not what you are looking for if you are someone who has had significant late payments, judgements, bankruptcy or other

Here’s the Breakdown:

and Although It depends on the type of negative information, here’s the average idea of how long different types of negative information will stay on your credit report:

- Late payments: 7 years

- Bankruptcies: 7 years for completed Chapter 13 bankruptcies and 10 years for Chapter 7 bankruptcies.

- Foreclosures: 7 years

- Collections: Generally, about 7 years, depending on the age of the debt being collected.

- Public Record: Generally 7 years, although unpaid tax liens can remain indefinitely.

Length of Time Matters:

For all of these negative items, the older they are the less impact they are going to have on your FICO® score. For example, a collection that is 4 years old will hurt much less than a collection that is 4 months old.

After that time it will be automatically removed from your report. But 7-10 years is a long time, and that negative information can be standing in the way of you buying a car, a house, or getting a good loan. Public records have a huge impact on your credit report and your credit score as well.

At Nationwide Credit Clearing, we help you get those items removed. There is no reason for those items to remain on your report for 7-10 years.

Positive Information:

All positive information on your credit report can stay there forever. The more positive information, the better your credit score will be

It’s time to start learning how to STOP LETTING BAD CREDIT AFFECT YOUR FINANCES. When you sign up with Nationwide Credit Clearing, we take the lead to work on your credit report and dispute unfavorable or inaccurate and outdated information. By doing this it will help save time, energy and frustration. More importantly we help to improve your credit score and ultimately fulfill your dreams… whatever they may be!

Nationwide Credit Clearing offers absolutely FREE – no credit card required – credit reports and consultations. To see your credit score, contact us now.

Comments