-

Get A free

Consultation Now!

Credit Repair

Own up to your Credit : Good or Bad

We all have made major mistakes either currently or in the past, especially when it’s regarding Money, Credit and Financial well being. Understand how you can set your self on a more effective financial route by owning up to most of your undesirable $$$ mistakes.

No one’s perfect – particularly when you are looking at managing your hard earned dollars. As you may always keep track of your funds, budget intelligently & spend well now, you may have made some significant money errors while you were young. Since having money does not come with an owner’s manual, you may have had lackadaisical spending ways or went wild with credit before you smartened up & began taking money as serious as you need to. Still, those past sins may come directly back to haunt you .. by way of creditors or really low credit scores. Your best bet would be to face money concerns head-on & compensate for those missteps before you can move on to more positive spending patterns in the future.

While confronting financial mistakes from your past, it is easy to turn a blind eye and hope they simply go away. However when you must pay back money or go into default on loans, not just are those creditors still looking to get paid, it will probably affect your long-term ability to secure funding & have what we like to call, Financial Freedom, in the near future. Rather, gather up all of your statements and read through them with a microscope to give you a general picture of which mistakes you’ve created & which can be easily rectified with a little bit of knowledge as well as hard work.

Understanding your credit is crucial.

So is a great score.

Get your credit report & Consultation NOW. Why wait? Call Today!

Nationwide Credit Clearing

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

Why Is My Overall Credit Score Important?

What Is A Credit Score?

A credit score is a three-digit number, typically between 300 to 850, which credit bureaus calculate based on information in your credit report. It is a simple, numeric expression of your credit worthiness. Although the three credit reporting bureaus (Equifax, Experian, and Trans Union), use similar methods to determine a credit score, the formulas they use are not exactly the same and your credit score will vary from bureau to bureau.

How is My Overall Credit Score Calculated?

Your credit score is calculated based on a number of factors listed in your credit history that describe components of your financial life including the number and type of credit accounts you have, the amount of available credit, the length of your credit history and your payment history. Each of these factors is assigned a numerical value, and then weighted based on how prominently they affect your credit worthiness.

How Do My Actions Impact My Score?

The good news is that no matter where your credit score is today, there are a number of different steps you can take now that can change your credit history and help impact your credit score. You should take all the steps you can to help establish a good credit score.

Why Should I Check my Credit History and Overall Credit Score?

In today’s digital economy, your credit history and credit score are vital pieces of information that are key to helping you secure your financial life. Credit card companies, mortgage lenders, and insurance companies will pull copies of your credit report and score in order to decide whether to extend credit or how much to charge for your insurance premium.

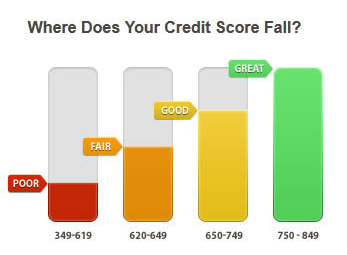

Financial services companies tend to group borrowers into segments according to their credit score. These credit score ranges may determine how much you’ll be charged for your insurance coverage or the interest rate you pay on your mortgage, student or car loan or the type of credit card you’ll be offered.

If you haven’t checked your score lately, or have interest in improving your overall credit score, contact Nationwide Credit Clearing.

We offer Free (no credit card required) consultations after we pull your free credit report. Contact us Today!!

X-5 Credit Repair System

New X5 Credit Repair is the newest software that has been rolled out by Nationwide Credit Clearing. This software is the most cutting edge on the market today. once you become a client, you will be able to login to your account online to view the status as well as send email updates frequently regarding the status of your deleted items.

Along with that, everytime your file is updated, you will receive a text message regarding the changes.

On another note, if you just happen to be a mortgage broker and you refer a client to Nationwide Credit, you will automatically become an agent so you can check on the status of potential clients credit reports and deletions.

Remember, Nationwide Credit Clearing is the #1 Credit Repair company in the industry, providing you with the ultimate in credit repair technology… contact us today for your FREE credit report and consultation.

Nationwide Credit Clearing

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

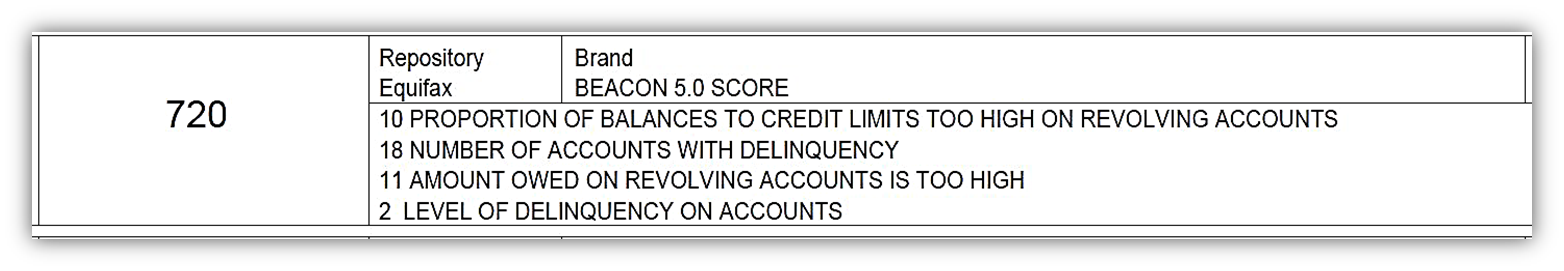

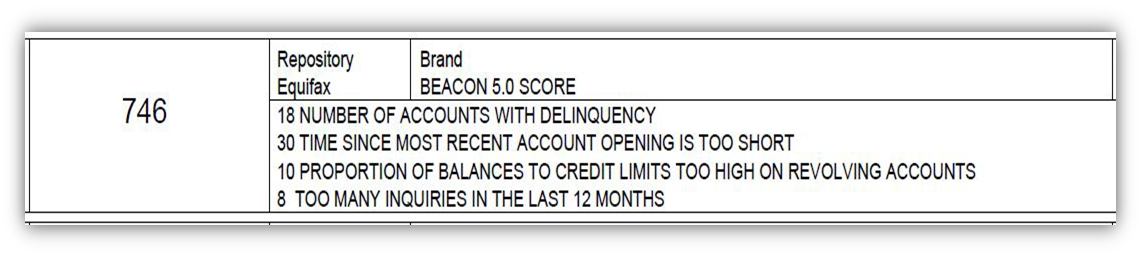

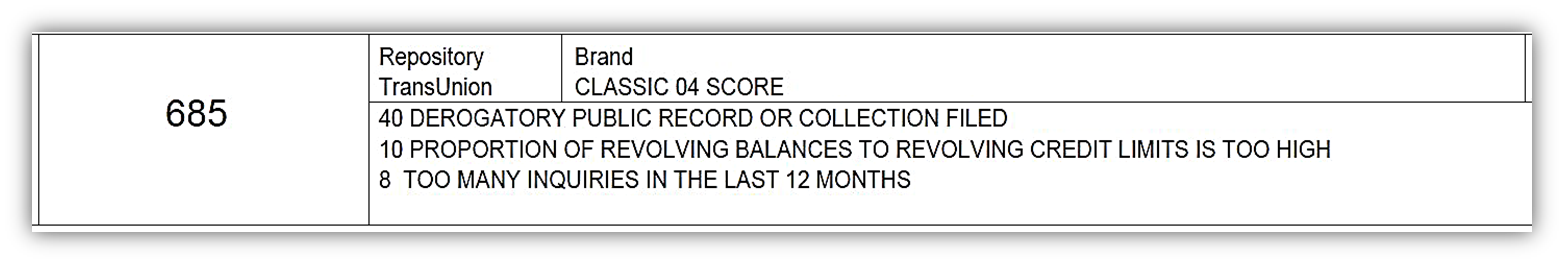

Credit Repair Results – A Case Study

Nationwide Credit Clearing has been in the credit repair business for 28 years and we have helped thousands of people eliminate deragatory items from their credit report. We handle all of the work for the clients from start to finish. We give the client a free credit report consultation on day one. For us. however, It’s not just about signing up clients- we want to help them reach their goals. We Care! This is how much we care….

Here is an example of a client we have been working with more recently, and you can see by the data below… WE GET OUR CLIENTS RESULTS…

EQUIFAX: Score increase 26 Points from 720 to 746

Before:

After:

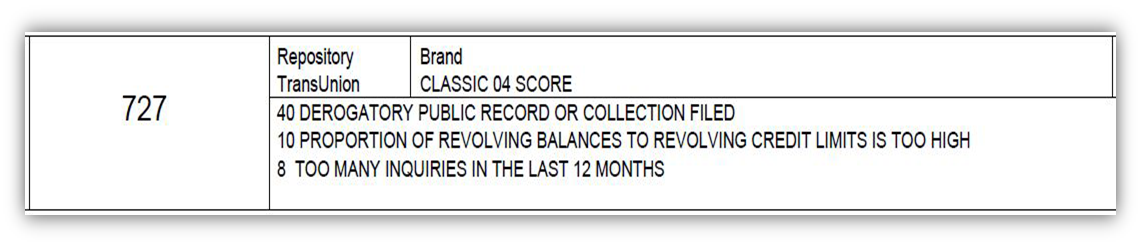

TRANSUNION: Score increase 42 Points from 685 to 727

Before:

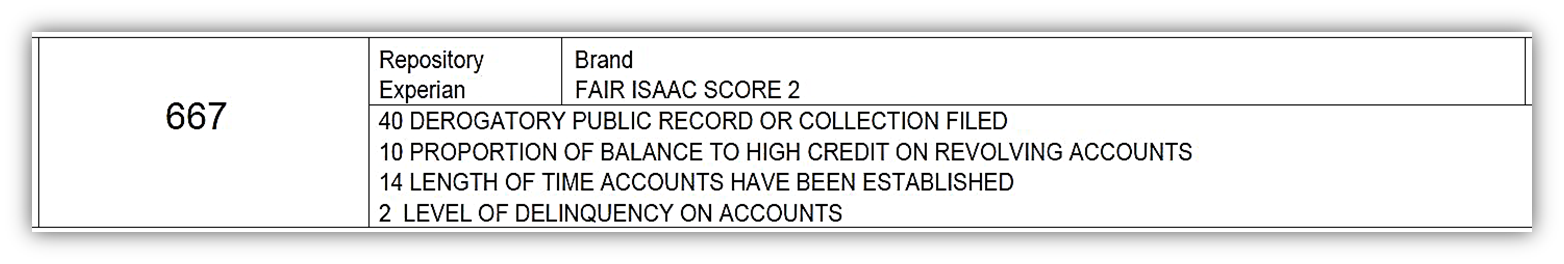

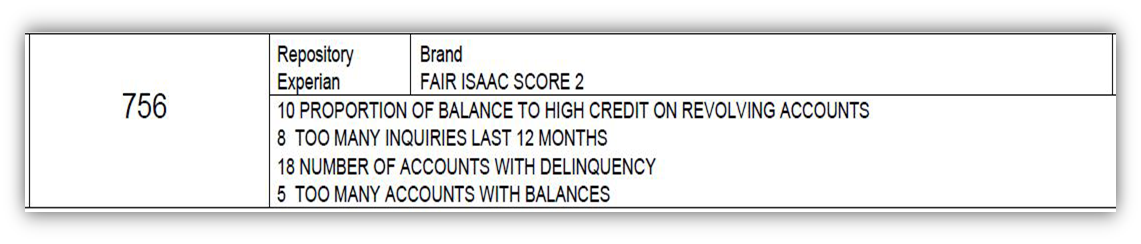

EXPERIAN: Score increase 89 Points from 667 to 756

Before:

After:

As you can see, we take your credit matters personally, and if we don’t get you results, we are not satisfied. If your new years resolution involves managing your money or increasing your credit score so that you can ultimately live a more fullfilling life, then you came to the right place.

As you can see, we take your credit matters personally, and if we don’t get you results, we are not satisfied. If your new years resolution involves managing your money or increasing your credit score so that you can ultimately live a more fullfilling life, then you came to the right place.

What are you waiting for? Click HERE to get your FREE (no credit card required) Credit Report and Consultation…

Nationwide Credit Clearing

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

Debt Solutions: Ways to Begin Eliminating Credit Card Debt

A lot of people end up with staggering credit card debt. Even though it seems overwhelming, trimming your financial allowance through small changes in your lifestyle might help.

Debt Solutions: Day-To-Day Savings

Take a seat and consider the amount of money you would spend throughout the week on coffee, lunches and takeout dinners. Somebody who spends $ 5 each day in the coffeehouse is looking at Hundred Dollar expenditure throughout the course of the month. Invest that first month’s savings on a at home coffee maker and travel mug so you’re able to take the coffee from your home. The same goes for your morning breakfast. You will begin to see extra cash in your pocketbook right away.

For lunch time, take the brown bag with you. The $10 or more you spend every day on one salad or perhaps a sandwich leads to over $200 monthly. Instead, buy salad fixings or lunch meat at the supermarket. For anybody who typically runs late each and every morning, pack your lunch the evening before to prevent adding precious minutes towards your morning routine.

This may be the toughest adjustment for families on the go, but it’s time to cut back on takeout dinners. These quickie meals are budget busters. A few cartons of Chinese food or a couple of pizzas can easily run you $30 or more a pop. Instead, keep frozen prepared meals on hand for those nights when cooking isn’t an option. Double your recipes and freeze batches of soup, chili and casseroles on weekends when you have time to cook. Even frozen prepared foods from the grocery store will save you considerable amounts of money. Avoiding expensive takeout even twice a week can save nearly $250 a month.

Debt Solutions: Monthly Payments

The initial place to search for simple savings is in your mobile phone, cable and Internet fees. Chances are you’re spending money on features you are not using. For people with every cable channel but aren’t big on watching TV, contact your cable company to find out what packages are available that still offer what you need. Your cell phone bill could possibly be another budget drain which can be trimmed through careful research of packages available.

You could search for a bundle package that provides you significantly lower rates on your Internet, mobile phones and cable by utilizing the same company for all those. Comparison-shop between providers and do not hesitate to let them understand what you have been proposed by their competitors. This tactic is known to sweeten many deals.

Debt Solutions: Big-Ticket Items

Make the most use out of your expensive items before replacing them. Keep appliances, cars and electronics until they are no longer useful instead of purchasing every new item that comes on the market. You could be in need of that new tablet, but stick to the existing laptop for a bit — it is not costing you anything at all. Invest a few bucks in repairs to maintain your big-ticket belongings in good condition, and wait to buy new items before you look for a deal you simply can’t pass by.

Now that you know more about how to eliminate credit card debt, get your FREE credit report & consultation from the #1 Chicago Credit Repair Company, Nationwide Credit Clearing.

Nationwide Credit Clearing

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail: support@mynationwidecredit.com

find us on…

The Twelve Days of Credit

The Twelve Days of Credit: A guide to unanswered questions about your Credit Report and History….

The Twelve Days of Credit: A guide to unanswered questions about your Credit Report and History….

1. Did you know an FTC study found that about 25 Percent of Credit Reports could contain errors?

2. Some credit scoring models essentially count multiple hard inquiries, as one. As long as both loans are for the same type – ie auto or mortgage – and within a short period of time.

3. Loans you have co-signed for could appear on your credit report the same as your other accounts do. If you are thinking of co-signing, consider your own credit score as well.

4. If you are concerned about Identity Theft, a Fraud alert could make it more difficult for someone to open a new account in your name.

5. Make sure to track your Credit Utilization Rate. Try keeping your Credit Card Utilization Rate below 30%. Higher utilization rates could negatively affect your overall Credit Score

6. Lenders could close your accounts due to inactivity. To keep your current credit accounts active, try to use them regularly for at least small purchase. Of Course you should never forget to pay your bills!

7. Adverse Accounts are accounts in which information may lead potential creditors to view you as a risk. Account information includes name, address and phone number of creditor, your account number, current balance and highest balance, account limit, account status, account type and the date you opened the account. The report lists how much money is past due and how many times the account a payment has been made 30/60/90 days late. Bankruptcies, liens, foreclosures and judgments will be listed in this section.

8. Debt Validation is a consumer’s right to challenge a debt and/or receive written verification of a debt from a debt collector.

9. If you are considering using Credit Cards to earn cash back or rewards points this

Season, be sure to read the fine print. Some cards require you to enroll in rotating categories or have other limits on rewards. Always check and ask your credit card issuer for specific Details.

10. Most bankruptcies filed in the Unites States are either Chapter 7 or Chapter 13 cases.

So what is The Difference?

• Chapter 7 is a liquidation bankruptcy designed to wipe out your general unsecured debts such as credit cards and medical bills. To qualify for Chapter 7 bankruptcy, you must have little or no disposable income.

• Chapter 13 is a reorganization bankruptcy designed for debtors with regular income who can pay back at least a portion of their debts through a repayment plan. If you make too much money to qualify for Chapter 7 bankruptcy, you may have no choice but to file a Chapter 13 case.

11. Late or missed payments Can and Will reduce your overall credit score. Considering enrolling in auto-pay if you are a busy person who tends to be forgetful.

And on the TWELFTH day of Credit …someone brought up Credit Repair….

12. Credit Repair is the easiest and fastest way to increase your overall Credit Score. We work hard to dispute unfavorable or derogatory items that currently exist on your Credit Report. One should consider Credit Repair when looking to buy a new car, a new home, or anything that involves the need to present your personal credit score.

About Nationwide Credit Clearing…

Nationwide Credit Clearing has been in the credit repair business for 28 years. Nationwide Credit is the “high end boutique” of credit repair. We handle all of the work for the clients from start to finish. We give the client a free credit report consultation on day one. For us. however, It’s not just about signing up clients- we want to help them reach their goals. We Care!

Nationwide Credit is the largest credit repair company in Chicago and was told by one of the major credit bureaus six years ago that we were one of the top 3 largest companies in the country. Having such volume going through our company has opened up the doors with the credit bureaus. Two out of the three updated credit reports are sent directly to the Nationwide Credit corporate office.

Now, isn’t it time you checked your current credit score? It’s easy, just Contact us Below:

Can’t get a loan because of low credit score?

If you have a low credit score or credit problems as a result of declaring bankruptcy or foreclosing on a home, or if your credit scores have dropped because of late payments or failure to pay, do not despair.

Although a good credit score can drop very quickly, at times taking a hit of as much as 150 points or more, it is possible to improve your credit over time and to qualify for a new mortgage loan. Boosting low credit scores is not the only means for people with deficient credit to get a home loan. The Federal Housing Administration (FHA), in an effort to promote homeownership, has made it easier for people with a damaged credit history to qualify for a mortgage loan. Under certain circumstances, people who have foreclosed or declared bankruptcy can obtain an FHA loan several years earlier than a conventional loan, and these people can buy a home with a smaller down payment.

Credit Scores & Lenders

Credit scores indicate to lenders how well you manage money. You can improve bad credit by demonstrating that you can now handle money more responsibly. Furthermore, since poor credit scores translate into high interest rates on home loans, an improved score will help you get lower interest rates when you are ready to qualify.

How to improve credit scores to qualify for a loan

Here are a few ways people with a negative credit history can raise their credit scores and ultimately obtain financing for a new mortgage loan:

- Improve payment history by making payments on time

- Do not open new lines of credit Use credit cards sparingly, and without overextending credit lines

- Make payments in full Have up to four different kinds of credit accounts

- Show evidence of steady employment for a period of one to two years

- Come up with a budget plan and stick to it

- Build up savings

Insider’s tip: Credit experts advise not spending more than 25 percent of your available credit on any credit card account. If you have a $1,000 maximum in a given account, the balance should not be more than $250-$300. Better yet, wipe the slate clean and carry no balance whatsoever.

Other options to consider

Credit Repair? Nationwide Credit Clearing can help you eliminate any incorrect or negative items on your report, ultimately allowing you to qualify for that home loan.

Give us a call today.

Nationwide Credit Clearing

2336 N. Damen

First Floor

Chicago, IL 60647

Phone: 773-862-7700

Toll Free: 877-334-3296

Fax: 773-862-7703

E-Mail:support@mynationwidecredit.com

How long does information stay on my Credit Report and how can Credit Repair help me?

This is a great topic because it is one of Most Frequently Asked Questions to credit repair companies by those who are trying to improve their overall credit score. The answer is probably not what you are looking for if you are someone who has had significant late payments, judgements, bankruptcy or other

This is a great topic because it is one of Most Frequently Asked Questions to credit repair companies by those who are trying to improve their overall credit score. The answer is probably not what you are looking for if you are someone who has had significant late payments, judgements, bankruptcy or other

Here’s the Breakdown:

and Although It depends on the type of negative information, here’s the average idea of how long different types of negative information will stay on your credit report:

- Late payments: 7 years

- Bankruptcies: 7 years for completed Chapter 13 bankruptcies and 10 years for Chapter 7 bankruptcies.

- Foreclosures: 7 years

- Collections: Generally, about 7 years, depending on the age of the debt being collected.

- Public Record: Generally 7 years, although unpaid tax liens can remain indefinitely.

Length of Time Matters:

For all of these negative items, the older they are the less impact they are going to have on your FICO® score. For example, a collection that is 4 years old will hurt much less than a collection that is 4 months old.

After that time it will be automatically removed from your report. But 7-10 years is a long time, and that negative information can be standing in the way of you buying a car, a house, or getting a good loan. Public records have a huge impact on your credit report and your credit score as well.

At Nationwide Credit Clearing, we help you get those items removed. There is no reason for those items to remain on your report for 7-10 years.

Positive Information:

All positive information on your credit report can stay there forever. The more positive information, the better your credit score will be

It’s time to start learning how to STOP LETTING BAD CREDIT AFFECT YOUR FINANCES. When you sign up with Nationwide Credit Clearing, we take the lead to work on your credit report and dispute unfavorable or inaccurate and outdated information. By doing this it will help save time, energy and frustration. More importantly we help to improve your credit score and ultimately fulfill your dreams… whatever they may be!

Nationwide Credit Clearing offers absolutely FREE – no credit card required – credit reports and consultations. To see your credit score, contact us now.

Comments

What is Considered a Good Credit Score?

Do you know what is a good credit score?

Still have questions?

Call the experts at Nationwide Credit Clearing

Nationwide Credit Clearing

2336 N. Damen

First Floor

Chicago, IL 60647

Phone

773-862-7700

877-334-3296

Fax:

773-862-7703

E-Mail:

support@mynationwidecredit.com