-

Get A free

Consultation Now!

Author Archives: Norm Schriever

Why is it so hard to open a bag of potato chips? The secret psychology of consumer engineering that tricks you into buy.

Why is it so hard to open a bag of potato chips?

Why is it so hard to open a bag of potato chips?

If you’re like most people, you may try to rip, pull, tear, find the little pre-cut slot, and otherwise mutilate the bag of snacks as you grow increasingly frustrated.

The chip companies are well aware of this inconvenience, yet keep putting out these bags despite plenty of simple solutions that make it easier for consumers. So why do they make bags of chips so difficult to tear open?

Research into consumer behavior shows that consumers are forced to work a little harder to get their food, they’re more likely to enjoy and perceive it as tasting better.

If you’re feeling a little duped, don’t be too hard on yourself because retailers and brands employ subtle psychological tricks and triggers like this in every inch of their stores and every aspect of their branding.

In fact, your experience as a consumer these days – from first seeing an ad to walking out of the store with a sales receipt – is carefully engineered, whether you realize it or not.

Shapes, displays, packaging, colors, music, smells, temperature, layout, fabrics, dress of employees and even how a woman (but never a man) touches you on the arm or the shoulder are all carefully planned prompts, based on neural psychology with the goal of getting you to do one thing: buy.

Here are some facts about consumer engineering and the tricks being played on you every time you walk in a store:

If a salesperson asks you which of two items you prefer (even if you haven’t expressed interest in one or both of them), it’s for a good reason. They know that when asked WHICH you want to buy, a consumer’s mind is more likely to skip over the question, SHOULD I buy at all.

Research shows that when a salesperson offers a confusing sales pitch but then immediately clarifies, the likelihood that you’ll buy that item increases.

The layout of stores is also carefully orchestrated. Basically, once you enter a store, you’re like a lab rat in a maze designed by consumer engineers!

For instance, have you ever noticed that when you go into a grocery store just to pick up a few staples, like milk, bread, or eggs, you have to walk all the way to the back and sometimes the furthest back corner of the store? That’s no accident, as the designers know that you’ll have to make it through myriad temptations and displays of impulse sales in order to get your items and “escape” to the checkout – and few do without picking up extra items.

Likewise, store designers set pathways and shopping aisles to maximize your time in the store and exposure to signature items that will draw you in. Think about how you have to walk through the expensive Duty-Free shops in the airport on the way to your gate.

They also place “roadblocks” in your way that inhibit the flow and slow you down or make you adjust, forcibly noticing displays and certain items.

Stores also maximize center displays and the end of aisles, which are far more likely to attract and engage shoppers.

But most people don’t realize that the highest-grossing items, merchandise for sale, and impulse purchases are also commonly placed on the right-hand side of aisles. They do this because about 90 percent of the population is right-handed, so they’ll be drawn to the right and see those items first, and shoppers usually push their carts on the right of aisles similar to driving a car on the road.

Why do retailers position “impulse items” like batteries, gum, magazines, sales items, at the end of aisles and especially in the checkout line?

A reported 6 percent of the U.S. population are compulsive buyers – which is a major shopping addiction – and almost half of all shoppers give in to these impulse prompts to buy. In fact, a reported 20% of all retail sales this holiday season will be due to impulse items and unplanned purchases.

Do you want to resist the impulse sale? If a consumer walks to a store, instead of driving, the chances that you’ll make an impulse purchase drops by 44 percent.

When surveyed, 66 percent of consumers say that they plan on researching gifts online but then go to a physical store or the mall to actually make the purchase.

Like Pavlov’s dog in the famous experiment about classic conditioning, we nearly salivate when presented with the word “Sale.” In fact, more than 75 percent of consumers polled say that a sale would impact their holiday gift purchases.

Is the music playing in the background of stores an afterthought, played just for entertainment value? Not even close. In fact, consumer psychologists carefully plan every aspect of the music, from song choice to volume and more. They understand that if shoppers like the music that’s playing, they’re more likely to enter a store, spend more time there, try on or touch the merchandise, and, ultimately, purchase. So that’s why you’ll hear Christmas music playing in every store!

But why all of the “elevator music” and mellow, slow versions of popular songs? While the familiarity with popular songs helps, research also shows that the slower the tempo of the music, the slower people will walk around the store. But with a fast song, customers will walk through and even make decisions faster, which means less interactive shopping and sales.

One of the most effective psychological tactics to motivate consumers to buy is the phenomenon of “limiting.” By capping purchases with language like “Limit two per customer,” or “Sale ends soon,” or “One-day sale only,” a fire is lit under shoppers to buy now (and for the maximum allowed) or miss out.

Human emotion is directly linked to the sense of touch. Therefore, when consumers pick up and touch items, they’re more likely to make purchases. That’s why retailers always make sure that items are tactile, easy to pick up, try on, and touch.

Retailers and ad execs know that the color red stimulates spending, so you’ll most commonly see red in advertisements and store logos (think red “sale” signs, the Target logo, etc.)

Even smells are carefully researched and orchestrated. It’s no mystery why stores use the smell of holiday candles and roasted chestnuts or offer free samples of freshly baked cookies to Christmas shoppers.

That’s the same reason restaurants or stores offer freshly popped popcorn, which triggers salivary glands and causes consumers to order more food – or even buy more non-food items.

In fact, one study found that pumping the synthetic smell of apple pie into an appliance store immediately increased the sale of ovens and fridges by 23 percent!

Retailers carefully plan psychological triggers that will make you feel more comfortable and eager to buy, even spending far more than you originally planned. They do this with the use of “social proof” that others are buying, too, and “trust signals” like money-back guarantees and indicators that your greatest risk, in fact, is NOT buying and missing out on such great deals.

They even train their store employees very carefully, especially in high-end and luxury stores. For instance, they’re taught not to ever engage in something called “the butt brush,” the psychological reaction that when a customer’s personal space is encroached upon, even slightly, they’re likely to leave the store, even if they were planning on making a purchase.

***

Want other psychological secrets, triggers, and ploys that retailers use on you? Look for part two of this article!

Can you achieve a perfect credit score? We’ll show you how!

When you get together with your friends, family, and coworkers, there’s always one person who loves to brag about how well they’re doing. It may be about their new car, high-paying job, or even the amazingly low interest rate they just got on their mortgage.

When you get together with your friends, family, and coworkers, there’s always one person who loves to brag about how well they’re doing. It may be about their new car, high-paying job, or even the amazingly low interest rate they just got on their mortgage.

So wouldn’t it be great if the next time they opened their mouth to be braggadocious, you could one-up them by reporting that you had a perfect credit score? There’s no topping that!

But there are plenty of financial benefits to a perfect (or excellent) credit score, too.

FICO, the most popular credit scoring model, issued by the Fair Isaac Corporation, ranges from 300 all the way up to 850. Generally, a score above 680 or so is considered “good,” and once you hit the 720 to 740 range, your score is considered “excellent.”

But there’s another level or two above that for consumers to strive for. In fact, 32.8 million people have FICO scores between 700 and 749, but approximately 70 million consumers have FICOs above 760.

Don’t stop there, because it’s possible to raise your credit score even higher. An estimated 36.4 million people have scores between 750 and 799, and 38.6 million are in the 800+ FICO range.

Only about 1% of consumers, around 2 million people, ever reach high-end 800-850 scores.

In fact, FICO estimates that only about .5% (half of one percent) of all consumers with a credit score have a perfect 850 FICO. To put in in context, the average FICO score in the United States has just reached 700 for the first time.

Remember that FICO isn’t the only credit scoring model, as there are dozens of other scoring models that banks and lenders use to make lending decisions, and then different versions of each depending on what kind of loan or even consumer they’re vetting.

So let’s say you reach an 800 credit score, or even an enviable 850 – a perfect credit score. Beyond bragging to your friends, what are the benefits?

An 850 credit score may not help as much as you think IF you compare that to another great score, like an 800, 780, or even lower. That’s because FICO uses algorithms that rate scores within “brackets,” which means that if you have above 750 or maybe 780, there really won’t be an additional benefit the higher you go.

“It’s important to understand,” reports FICO spokesman Anthony Sprauve, “that if you have a FICO score above 760, you’re going to be getting the best rates and opportunities.”

For instance, a consumer with an 850 FICO will most likely be offered the same mortgage interest rate, auto loan rate, or 0% interest credit card offer as another consumer that “only” has a 780 score.

While you may expect little perks, additional beneficial terms, and premium services with a perfect credit score, you most likely won’t see any huge benefit once you reach the “super-prime” scoring bracket.

So why strive for a perfect score? Remember that credit scores are dynamic, constantly going up and down, so today’s perfect score may be a little less next month. Furthermore, it certainly doesn’t hurt to aim for a perfect score and still have an excellent FICO even if you fall a little short. And since your credit score is a good indicator of your financial acumen and dealings with debt, a perfect credit score most likely means that your financial house is well in order.

Whether you want a perfect credit score – or just trying to improve your score until you reach 700 or even 800 – here are ten important strategies:

- Pay on time (and never miss a payment)

Even one late payment can hurt your score, and paying on time is about 35% of how FICO calculates your score. In fact, 96% of people with a FICO score of 785 or greater have no late payments on their credit reports.

- Pay down your balances

Your credit utilization ratio – how much debt you keep compared to total available balances – makes up about 30% of your credit score calculation. While you commonly hear that you should pay your credit cards and debt down below 30% of the available balances, to shoot for that perfect credit score, you’ll want to pay then down to 10% or below. In fact, a survey of consumers with 800+ scores revealed that their average credit utilization rate was just 7%.)

- Keep older and seasoned accounts

About 15% of your credit score is calculated by the length of your accounts, so older is better. According to FICO research, the average credit super scorer has an account that’s 19 years old. Likewise, the average age of their accounts is between 6 and 12 years, and they opened their most recent account 27 months ago or more.

- Keep a good mix of credit

10% of your credit score depends on managing a healthy mix of credit, including mortgages, installment loans, and high-quality revolving accounts. Consumers with FICO scores 760 and up have an average of six accounts that are currently “paid as agreed,” and an average of three accounts with a balance.

- Shop around in clusters

When you have your credit pulled to “shop around” for a loan, make sure it’s within a 30-day window and FICO won’t factor those pulls into your score. Even if they are spread out within 45 days, they’ll only be treated as one credit inquiry.

- Check your credit report often

About 25% of all credit reports contain errors, and ID theft and fraud affect about 1 in 8 American consumers. So to achieve a great score, check your score frequently and consider a credit monitoring service.

- Make payments before the due date

To earn an 800+ credit score, make payments well before you receive your bill and the due date. Try paying off (or down) your purchases at the end of every week for the best credit score.

- Increase your credit limit when offered

Another way to improve your credit utilization rate and boost your score is to take advantage of any offers to increase your credit line.

- Stick to one or two good credit cards

It’s best if you only use one or two cards on a regular basis. American Express is a great choice, as the balances don’t report to FICO since you pay them off in full every month.

- Improve your score with Nationwide Credit Clearing!

We’re the trusted leader in credit repair done right. Contact us at (773) 862-7700 or MyNationWideCredit.com for a free report and consultation so we can get you started on the way to a perfect credit score!

Answering the top-10 Google searches about credit and credit scores

Google is by far the world’s biggest search engine, with about 63% of all search traffic and 30 billion inquiries every month. In fact, type in “credit score” and you’ll get more than 69 million results! While we won’t try to answer all of those queries, here are the top 10 Google searches about credit and credit scoring:

Google is by far the world’s biggest search engine, with about 63% of all search traffic and 30 billion inquiries every month. In fact, type in “credit score” and you’ll get more than 69 million results! While we won’t try to answer all of those queries, here are the top 10 Google searches about credit and credit scoring:

- How is my credit score calculated?

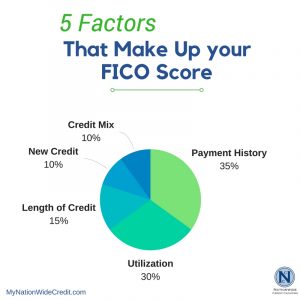

There are several versions of your credit score, but the most common is issued by the Fair Isaac Corporation (FICO). While FICO keeps its credit scoring algorithms secret, we do know that the fundamental building blocks of any credit score are:

30% Credit utilization.

Your ratio of debt to available credit. It’s recommended you keep all of your debt balanced within 30% or less of your total available credit.

35% Payment history.

FICO and the other credit bureaus want to see that you’ve paid on time and in full every month, an important predictor of future payment behavior.

15% Length of credit history.

The longer your accounts have been open and in good standing, the better it reflects on your credit score.

10% Mix of credit.

A good mix of quality revolving accounts, mortgage debt, and installment debt, etc.

10% New credit.

Opening new accounts – or the wrong credit – is deemed risky and can lower your score.

- How much will a late payment hurt my credit score?

Since 35% of your credit score is based on your payment history, you always want to avoid paying any credit card or account late. Generally, if you do pay after the due date, your score will drop about 80-100 points. But you definitely don’t want to miss a payment for 60 days or even 90 days, which will cause serious damage to your credit score.

- What credit score do you need to buy a house?

If your goal is to buy a house, you’ll want to start with the mortgage process, and that means making sure your credit score is good enough to qualify for a loan, among other factors. While you’ll always have access to the best programs, terms, and the lowest interest rates with a great credit score (above 720, or even about 760 are considered “prime” scores), there are options for homebuyers with lower scores.

The Federal Housing Authority (FHA) has a great loan program that allows you to put only 3.5% down and qualify with a credit score in the 600’s, or possibly even lower in some circumstances. However, it’s always a good idea to come talk to us about six months before you plan on applying for a mortgage so we can increase your credit score and save you money.

- Will it hurt my score if my credit is pulled several times while I shop for a loan?

When you apply for new credit cards or loans with multiple creditors at the same time, it may signal to the credit bureaus that you’re recklessly taking on new credit – an indicator of future default. Therefore, your credit score may drop with these “hard” credit inquiries.

But the credit bureaus also understand they most consumers want to “shop around” for the best rates and terms when they’re making big purchases, like mortgage or auto loans, and that means having your credit pulled more than once.

To make allowances for this common consumer practice, the credit bureaus don’t ding you a batch of inquiries, as long as they’re within a 30-day period or less. Just don’t overdo it, or have your credit pulled from different kinds of debts (credit card, retail, etc.) or it will signal to them that you’re desperate to take on new debt, and your score will drop.

- Why is it important to check my credit report often?

The news these days is filled with reports of data leaks and hacks, such as the recent one of Equifax’s database that saw 235 million records compromised. Identity theft is the fastest growing crime, and most of that sensitive financial information is obtained online. For that reason, you should be checking your credit report often to screen for accounts that have been opened in your name. Likewise, the credit bureaus make a lot of mistakes when it comes to credit reporting – which could impact your score. In fact, it’s estimated that 50% of all credit reports contain errors, duplicates, or misreported information!

- How long will a bankruptcy/foreclosure/judgment stay on my credit?

Most delinquent items will report on your credit for 7 years before falling off, but there a few exceptions:

Charge-offs stay on your report for 7.5 years from the first missed payment.

Chapter 7 bankruptcies remain for 10 years from the date filed.

Chapter 13 bankruptcies remain for 7 years from the date discharged or a maximum of 10 years.

Student loans can remain on your credit until they’re paid.

Foreclosures and short sales will probably report for the full 7 years, but the negative impact will diminish over time. But changes in the industry now make it possible for some people to buy another home in as little as 1-2 years.

If you’ve experienced one of these negatives, contact Nationwide Credit Clearing.com so we can start repairing your credit and get you on the track!

- What happens if my husband/wife or cosigner on a loan and the other person defaults?

When it comes debt responsibility among married couples, different states have different laws. Community property states (include Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin) deem that you’re responsible for your partner’s debts if they were charged up during the marriage. Even if you get divorced, you’re both accountable for the debt, and it will show on both credit reports.

That’s also the case when you co-sign for a loan with someone else – the debt obligation is shared, but both parties are fully responsible. So if the other person fails to pay, or even misses a payment, your credit score will go down, and the creditor will pursue you, too.

- Why is a good credit score important?

A good credit score can save you thousands or tens of thousands of dollars on mortgage loans, credit card interest rates, car and student loans, and even insurance. Many employers are even now looking at credit reports when screening applicants!

- What is credit repair/How can credit repair help me?

Credit repair is a process where you try to clear up inaccurate, outdated, or other misreported negative items on your credit history so that your score will go up. Credit repair entails a formal procedure where we send dispute letters to the credit reporting agencies to challenge the validity of negative information. The credit bureaus are governed by the Fair Credit Reporting Act, which requires them to either fix the problem or respond with evidence that it’s true within a certain timeline. Either they will fix the inaccurate negative credit item, or, if they don’t have evidence or don’t respond in time, the item will be removed. Both outcomes help your credit score rise to where it should be.

Credit repair done through an experienced and trustworthy firm like Nationwide Credit Clearing can increase your score, remove incorrect information, and save you a lot of money in the long run.

- Do I have to pay to check my credit score?

According to the Fair and Accurate Credit Transactions Act (the FACT Act), you are eligible to receive a free copy of your credit report once each year from each of the three major credit bureaus by going to www.annualcreditreport.com. This will show your credit history, not your score, but at least you’ll be able to monitor your credit activity and make sure you’re on track.

***

For a more in-depth look at your credit score, credit report, and what you need to do to improve and save money, contact Nationwide Credit Clearing.com for a FREE credit report and consultation! We’re here to help you!

Just how much money will you save with a good credit score? The answer may shock you!

Most people don’t think about their credit score on a daily basis, even as they use their credit cards, make their auto loan payment, or write a sizable check for their monthly mortgage. However, there’s a direct correlation between a good credit score and saving on all of these accounts – and more.

Most people don’t think about their credit score on a daily basis, even as they use their credit cards, make their auto loan payment, or write a sizable check for their monthly mortgage. However, there’s a direct correlation between a good credit score and saving on all of these accounts – and more.

The top credit scorers typically save tens (or even hundreds!) of thousands of dollars over their lives, helping them pay off debt, amass savings, invest to retire comfortably, or achieve their other financial goals.

Meanwhile, consumers with subprime or even average credit scores get charged higher interest rates, fees, and see a lot of doors closed when they apply for new loans.

So how much money will a great credit score actually save you? Let’s take a look:

Credit Cards:

According to Bankrate.com, if your credit score falls between 600-679, the average U.S. credit card APR (annual percentage rate) is 22.9%

But if your score is in the 680-739 range, your APR drops significantly to 17.99%.

However, for the highest credit scores in the 740-850 range, the average APR is only 12.99%.

So how much can those lower credit card interest rates save you?

Looking at a popular tiered credit card with a $10,000 balance as an illustration, we see that with the lower 12.99 percent APR for high-score consumers, the monthly payment would be $297 for over five years to pay it off. But if you had that that higher 22.9% rate because your credit score was mediocre, that monthly payment would jump up to an astronomical $715…and for more than 7 years!

Therefore, keeping a great credit score could be the difference between paying $18,414 total to pay off this card or $44,330 – a whopping $25,000+ savings!

Auto financing:

When it’s time to purchase a car and apply for auto financing, your rates and terms can vary widely. But one thing is for sure: a great credit score will save you a lot of money when you’re paying off that shiny new auto month-after-month.

According to VantageScore, which is the main purveyor of credit scoring for auto lenders, a typical $25,000 auto loan for a 5-year term:

- Below 550 Vantage Score (poor credit): 18.9% with $13,828 interest paid

- Below 620 score (subprime credit): 17.9% with $13,009 interest paid

- 620 to 680 credit score (average): 11% with $7,614 interest paid

- 680-740 credit score (good): 6.5% with $4,350 interest paid

- 740-850 credit score (excellent): 5.1% with only $3,375 interest paid

While a 760 is considered a top-notch credit score for mortgage lending, you’ll probably qualify for the best auto financing with a 720 or higher score. In fact, consumers with excellent credit scores may even qualify for 0% financing on new car purchases.

Mortgage:

One of the biggest ways your credit score will save you huge bucks is when it’s time to buy a home. And unless you’re paying cash for that home, you’ll be applying for a home loan, with rates and pricing based heavily on credit score.

Assuming that the average sales price of a house is $343,300, with a mortgage of $274,640 (20% down payment) and a 30-year fixed mortgage:

Let’s start with a 5% interest rate just for illustration purposes (historically, that’s low, but right now it could be a little high):

Your monthly payment will be $1,474

Total payoff over 30 years is $530,758 (interest and principal payments)

But if you have a better-than-average credit score and qualify for a 4.5% interest rate on that same loan, your monthly payment will be $1,392 with a total payoff of $500,962.

And if you have a great credit score that grants you a 4% interest rate, that means you’ll only pay $1,311 per month with a $471,960 payoff

So how much will a good credit score save you when it comes to this typical mortgage illustration?

-Savings in 1 year (compared to a 5% rate)

4.5% $984

4% $1,956

-Savings in 5 years

4.5% $4,920

4% $9,780

-Savings in 10 years

4.5% $9,840

4% $19,560

-Savings in 30 years

4.5% $29,796

4% $58,736

And for a $500,000 home, the difference between a 760 and a 620 credit score could cost you about $150,000 or more in additional interest payments due to higher rates!

In fact, according to Michelle Chmelar, the vice president of mortgage lending with Guaranteed Rate, every 20-point step down from a 760 credit score could cost the borrower 25 basis points when it comes to pricing, as well as higher fees and closing costs.

Other ways a good credit score will save you money:

Qualify for the best credit cards:

With a top score, you’ll have the best credit cards jockeying for your business, offering the lowest interest rates (sometimes even 0% for a period), options for low or no annual fees, and great perks and rewards. The credit card companies will also gladly extend you higher balances. Together, this can save you hundreds of dollars every year.

Better car insurance deals:

You may not have known that car insurers also rate and apply coverage based on credit scores. While some states, like California, Hawaii, and Massachusetts, don’t allow car insurance companies to look at credit, in most states, you’ll see much lower premiums with a better credit score – saving you money.

Cheaper cell phone plans:

If you’ve walked into a store recently to buy a new cell phone, you were probably asked to authorize a credit score check. In fact, cell companies will require a hefty security deposit and might even charge you higher rates – or outright deny you a contract – if you have enough blemishes on your credit report.

Get approved for rental housing and apartments:

Most landlords include an authorization for a credit check when you submit an application, and your payment history is a pivotal factor in approving you for a lease. Likewise, if you have judgments from past landlords or collections from utility companies on your credit history, you can probably kiss your chances of getting that nice apartment goodbye.

Utility bill savings:

When it’s time to sign up for a new electricity, heating, water, or trash account, a bad credit score can cause some serious problems, In fact, most utility companies will charge increased security deposits – sometimes hundreds of dollars – for bad credit consumers.

Make the grade with student loans:

The average college graduate now leaves school with $37,172 in student loan debt, an increase of 6% (or +$2,200) over just last year. You better believe that a great credit score will help you qualify for lower-interest student loans!

Don’t miss out on your dream job:

A bad credit score can hurt you in ways that have nothing to do with taking out a loan. In fact, employers are screening their potential employees for credit score, especially with government jobs or those in the financial sector. It’s estimated that 1 in 4 Americans have been subjected to a credit score check when applying for a job, and 1 in 10 have actually been denied a job because of a bad score or something on their credit report!

***

Are you ready to start saving money? Let’s start with your credit score! Contact us for a free consultation and credit report.

Millennials aren’t making the grade when it comes to credit.

When it comes to Millennials, the financial picture is less than glowing – including their credit scores. With 83.1 million young adults in our country between 18 and 34 years old (born between 1981 and 1997), Millennials are the largest demographic in U.S. history.

When it comes to Millennials, the financial picture is less than glowing – including their credit scores. With 83.1 million young adults in our country between 18 and 34 years old (born between 1981 and 1997), Millennials are the largest demographic in U.S. history.

They’re also impossible to ignore since by 2025, they’ll make up about one-quarter of our total population and three-quarters of our workforce (about 53.5 million workers).

Still, research shows that Millennials are seriously stumbling when it comes to their credit scores, debt, and financial acumen.

Here are 25 facts about Millenials and debt, loans, and credit scores:

1. According to NerdWallet.com, the average Millennial credit score is only 628, the lowest of any age group in the country and significantly lower than the 700 average American FICO score.

2. Millennials may be young, but they’re already saddled with debt at an alarming rate, with an average of $23,332 in debt each. For reference, Gen X’ers have an average of $30,039 debt.

3. According to TransUnion, 43% of all Millennials have bad credit, considered subprime borrowers. The next highest group is Generation X with 33% bad credit, and only 20% of Baby Boomers.

4. Furthermore, only 6% of millennials have credit scores in the super prime (781 to 850) category, compared to 34% of Baby Boomers that achieve those credit score heights.

5. In fact, 28% of all Millennials have a credit score of 579 or lower. That’s one in four young people with a dismal credit score!

6. Other research shows that approximately 67% of all young adults under 30 have credit scores of 681 or less – two-thirds that don’t have good scores.

7. However, low credit scores may not be 100% their fault when we consider that the length of credit history makes up 15% of any person’s credit score. Of course, Millennials are far more likely to have shorter credit histories (and fewer accounts). So not only do they miss out on any score boost from seasoned credit lines, but missed payments or negative item wreak havoc on their score.

8. The most disturbing part is that Millennials seem to understand credit scores and credit reporting far less than any other generation, In fact, 44% of Millennials don’t even know what their credit score is right now, and only one in five have checked their credit report in the last year!

9. When they are granted new credit accounts, Millenials are also using it to rack up consumer debt at a higher rate than any generation. In fact, the average Millennial has $59,154 available credit but uses $47,089 of it – an astronomically high 79% credit utilization ratio.

10. While these numbers are averages, looking deeper, we see a different story. Since about one-third of Millennials have never even applied for a credit card (and have no credit card debt), we see a portion of this age group that has amassed huge debt loads.

11. Of course, it makes sense that Millennials are also applying for credit cards at a higher rate than any other demographic, exceeding the U.S. average.

12. As we documented, they’re spending more on their credit cards and credit lines once they’re approved. In fact, Millennials now have an average debt (not including mortgages) that equals 77% of their income, compared to the national average of 49%!

13. The burden of student loan debt weighs most heavily on Millennials these days, with student debt skyrocketing 56% in the last decade to nearly 1.2 trillion dollars.

14. 38% of Millennials carry student loan debt, and 42% of Millennial households have student debt.

15. The average graduate leaves school with nearly $30,000 in student loans. Among all Millennials, the average student loan balance of $17,200 with $351 in monthly payments.

16. But their debt doesn’t just come from investment in education, with 35% of this age group also carrying an auto loan. On average, Millennials with car loans owe $11,000 owed and pay an exorbitant $503 in monthly payments!

17. Furthermore, only 20% have a home loan, which can be considered “good debt.”

18. When they do apply for credit cards or new credit (like store retail accounts), almost half (48%) of Millennials do so as an impulse decision – on the spot at a store, sporting event, mailing offer, or when an offer pops up online, etc.

19. A high debt load puts a strain on their monthly budget, often preventing Millennials from buying their first home.

20. Where do Millennials live?50% of Millennials rent on their own,Only 26% own their home, condominium, etc.,21% of Millennials still live with their parents,and 3% live in military or student housing.

21. Additionally, between 2006 and 2013, the number of young adults living with their parents jumped 15%, which means an additional 10 million working-age people still living at home.

22. Millennials are now renting for an average of six years before they buy their first home.

23. In a Fannie Mae survey, Millennial renters gave their top reasons why they weren’t buying a home. 57% of respondents said that they weren’t buying for financial reasons, including:

- Insufficient credit score or history

- Affording the down payment or closing costs

- Insufficient income for monthly payments

- Too much existing debt

(That’s right – a credit score that’s too low is the #1 obstacle to home ownership according to Millennials, followed by saving for a down payment).

24. According to financial polls, 62% of Millennials have less than $1,000 saved – and 21% have no savings at all!

25. In fact, a recent survey by SurveyMonkey found that almost half of all adults age 18 to 34 spent more on coffee than they contribute to investing for retirement! It’s true – about 44% of females and 35% of male Millennials spend more at Starbucks than in their 401K or retirement planning.

Still, the news isn’t all negative when it comes to Millennial home ownership, as one in three (33%) homebuyers in 2017 are Millennials, and 68% of first-time buyers this year are in that age group.

***

Are you a Millennial and you’d like to improve your credit score? In college or just graduated and already facing debt? Or maybe your son or daughter needs some credit score help? Message us for a free consultation!

8 Ways to protect yourself from ID theft and financial hacks

We’ve all been carefully watching the news as details of the Experian credit hack unfold, but one thing is for sure: no one is safe from the threat of identity theft.

We’ve all been carefully watching the news as details of the Experian credit hack unfold, but one thing is for sure: no one is safe from the threat of identity theft.

In fact, according to data by the National Crime Victimization Survey/U.S. Bureau of Justice Statistics, 7% of U.S. adults 16 or older have been victims of identity theft.

Shockingly, across the world last year alone, 4.2 billion personal records were stolen by hackers and data thieves!

So there’s a strong chance that you may have your data compromised at some time in your life, and 86% of identity theft victims suffer the fraudulent use of one of their current financial accounts like a credit card or bank account.

Surveys show that 85% of Americans have already taken steps to prevent identity theft, such as shredding financial documents or changing passwords. But now more than ever, it’s critical that you take you fortify yourself against identity thieves.

Is a credit freeze the answer?

Many media outlets and credit “experts” have been advising people to place a freeze on their credit report.

Credit freezes do offer some protection since lenders won’t be able to pull your credit report and new accounts can’t be opened in your name.

To request a freeze, you have to contact each of the credit bureaus, Equifax, Experian, and TransUnion, separately, and each one will have details, terms, and restrictions on their website.

While freezes will protect against new accounts being opened in your name, they don’t even prevent the most common type of identity theft these days: misuse of existing accounts. In fact, only 4% of identity theft victims have new accounts opened in their names according to Bureau of Justice Statistics data

So what other options do you have to keep your identity safe?

Get a copy of your credit reports

It’s important to start by carefully reviewing all three of your credit reports for errant accounts or suspicious activity. You can request a free copy of your credit reports from TransUnion, Equifax and Experian or contact MyNationwideCredit.com for a free report and consultation.

Check your financial accounts

You should also monitor each of your financial accounts, including all credit card and bank statements. Even tax refunds have been a growing target of fraudsters, so IRS records also need to be reviewed.

Set strong passwords

The first line of defense against internet fraud and identity theft is setting strong passwords. The average person now has dozens of passwords that they enter online, many of them for sites and accounts that hold sensitive financial information.

When setting passwords, avoid personal information like birthdates, addresses, and family names. Use nonsensical combinations of letters and include numbers and !*#. You should also avoid using the same password for every account, and be careful about user names and what other information you store in internet accounts.

Enroll in a credit monitoring service

To ramp up your protection against identity thieves, consider enrolling with a reputable credit monitoring service. A good service will track all activity on your credit report every day, notifying you if there are any changes, such as a hard inquiry used to open new accounts or erratic charges.

Alert the authorities immediately

If you see suspicious activity or that you’ve been the victim of identity theft or fraud, contact the authorities immediately. You can file an identity theft report with the Federal Trade Commission (FTC) at identitytheft.gov.

The FTC also recommends that you file a report with your local police department if you’ve been the victim of identity theft.

Place a fraud alert on your credit reports

A fraud alert on your credit reports will raise the level of scrutiny and caution on your accounts if you suspect that you’ve been the victim of identity theft or even just a data hack. Creditors will need to contact you before opening any new credit lines or accounts. You only need to file a fraud alert with one of the credit bureaus since they are required to instruct the other two bureaus to do the same.

There are two kinds of fraud alerts. An initial fraud alert requires that a lender call you or make “reasonable steps” to contact you and confirm the new activity is valid and will last 90 days.

Extended fraud alerts are available if you’ve been the victim of ID theft and have a police report to prove it. You can only file an extended fraud alert one time but it lasts for seven years, and it requires that a credit contact you to verify new activity.

Register a credit lock

On face value, credit locks and credit freezes offer similar benefits, including preventing someone else from opening a new account in your name. But there are also some huge advantages to credit locks that you should consider. (You can’t institute a credit freeze and a credit lock at the same time.) In fact, credit freezes offer additional levels of protection over freezes, and also cost less.

Unlike locks, credit freezes are guaranteed by state law, so you have a level of legal protection. And while freezes can take a little time and effort to activate and deactivate, locks are initiated using an app on your smartphone and can be produced or discontinued immediately.

(However, only TransUnion and Experian offer instant credit locks, with Experian’s TrustedID Premier lock system taking 24-48 hours to process).

Similarly, only two bureaus (this time, TransUnion and Equifax) offer free credit locks, so you’ll have to pay for Experian’s CreditWorks lock program. But it’s still probably worth it considering that Experian’s credit lock program also offers daily credit monitoring and alerts.

***

Do you have any questions about the Experian hack, how to monitor and safeguard your credit and protect from ID theft? Contact Nationwide Credit Clearing for a free credit report and consultation!

The 5 Factors That Go Into Your FICO Score

Your FICO® score is a major factor when it comes to getting approved for a loan or new credit. In fact, the Fair Isaac Corporation (FICO) is used by 90% of top lenders and banks around the country to help gauge whether you’re a good candidate for new credit, as well as the interest rate they’ll offer. In total, it’s estimated that FICO scores are used for up to 10 billion decisions about credit around the world each year!

However, FICO has closely guarded their credit scoring algorithms, so we don’t know exactly how their computations will raise or lower our scores. But the good news is that FICO does publicize the specific factors that play into a credit score.

“FICO scores give the most attention to how you have paid back lenders in the past,” says FICO spokesman Craig Watts, “and how much you are using of the credit available to you, as shown on your credit report. Those two factors contribute roughly two-thirds of a typical person’s FICO score.”

Let’s take a closer look at those five factors that go into your FICO score:

35 % of your total FICO credit score.

The single most important factor that influences your FICO score is your record of replaying past debts. This makes perfect sense, considering that past behavior of paying off debts on time and in full is the biggest predictor of future repayment.

When it comes to your payment history, FICO looks at both revolving loans, such as your credit cards, and installment loans, like mortgages or student loans. In fact, we do know that your FICO score will drop more if you miss a payment on a large installment loan, like your home mortgage, over a smaller credit card, for instance.

To achieve a great credit score:

The single best way to improve your FICO or keep it high is to make all of your payments on time every single month.

Credit Utilization

30 % of your total credit score.

Almost as prevalent as payment history is your credit utilization, or the percentage of available credit compared to what you already owe. Creditors are wary to lend more to consumers who consistently max out their revolving accounts and consistently spend up to their limit without a buffer. Their research shows that these folks are more likely to miss payments or default in the future f they’re already constantly spending every dollar they have available as credit.

To achieve a great credit score:

Common advice is to keep all of your credit cards and revolving debt at around 30% of the total available credit. However, FICO’s research shows that borrowers with the highest credit scores tend to have a credit utilization ratio around 7 percent or so.

Length of Credit History

15 % of your total credit score.

All accounts aren’t created equal when it comes to credit scoring, with the accounts that have been open the longest helping your score more than recently opened ones. This factors into your length of credit history, as well-seasoned accounts are a better indicator of a consumer’s responsible payment pattern. Therefore, even if they’ve never missed a payment or done anything wrong, a borrower with only new tradelines on the credit report will never have a perfect score.

To achieve a great credit score:

Make sure to keep older accounts in good standing and think twice about paying off and closing any well-seasoned accounts (including with balance transfers), as it may hurt your score.

New Credit

10 % of your total credit score.

About 1/1oth of your FICO score is determined by what kinds of new credit you’re adding – and applying for. When consumers start applying for credit cards and other credit too often within a short period of time, it indicates financial desperation or risky spending patterns, and their score may drop accordingly. The exception is when borrowers are applying for a big purchase like a mortgage or auto loan, as it’s expected that they’ll “shop around” a little.

To achieve a great credit score:

Don’t apply for new credit frivolously, and mind the quality of the new tradeline, too. Just because every retail store, department store, and credit card mailer is offering you more credit, you probably don’t want to take it.

Credit Mix

10 % of your total credit score.

To show a healthy mix of credit and financial acumen, FICO looks for a mix of different credit accounts, including credit cards, retail accounts, installment loans, finance company accounts and mortgage loans. If a consumer has all credit cards, for instance, it may indicate a risky imbalance, and their score would be dinged accordingly. FICO’s data has shown that if a borrower has a good mix of credit, they have a higher chance of paying on time in the future.

To achieve a great credit score:

Take a look at the type of credit accounts on your report and balance it out with an installment loan, paying off an unneeded credit card, etc.

***

We now know the five factors that go into your FICO score, and what best practices to follow to keep a great credit score. However, your situation could be a little different based on what’s on your credit report and your credit history, so you should get help from a credit professional to maximize your score.

If you’d like help with your FICO score, contact us for a free consultation today!

25 Facts about the Equifax hack – and what you can do to protect yourself

1. Equifax – which is one of the country’s big three credit bureaus (along with TransUnion and Experian) recently suffered a significant data breach.

1. Equifax – which is one of the country’s big three credit bureaus (along with TransUnion and Experian) recently suffered a significant data breach.

2. In fact, according to the company, the personal data and even some financial records for up to 143 million Americans has been compromised – which amounts to about half of the total U.S. adult population!

3. Equifax (EFX ) is a private company that’s traded on the New York Stock exchange with a mandate is to earn profits for its shareholders, which it did to the tune of over $3 billion in revenues in 2016.

4. Along with TransUnion and Experian, makes money by collecting your financial and demographic information, analyzing it in the form of a credit report, and then selling that data to lenders, banks, mortgage companies, auto dealers, credit card firms, and yes, even marketers.

5. However, although Equifax tracks the payment and credit statistics for nearly every American adult (a small number are what’s called “Credit Invisible”), they don’t seek our permission, nor is there a way to opt out or keep your data private.

6. Equifax’s negligent mishandling of the situation has been highly publicized. The timing, for one, is of grave concern. Reportedly, Equifax knew about the data breach as early as mid-May but didn’t announce the hack publically until July 29.

7. Industry reports point to the fact that the security breach in Equifax’s platform existed for nine years without being fixed, and hackers slowly siphoned off consumer information for months.

8. Signaling that some serious malfeasance took place, three high-level Equifax executives sold shares of their own holdings after the hack was discovered, but before it was made public.

9. These three inside-trading execs, including Equifax’s Chief Financial Officer John Gamble, made $1.8 million from the sales of Equifax stock – before stock prices fell upon news of the hack.

10. By cracking Equifax’s database, the cybercriminals were able to obtain consumer records including names, Social Security numbers, birthdates, addresses and driver’s license numbers – all of the information they need to open new accounts or commit identity fraud.

11. According to credit expert John Ulzheimer, those pieces of data are “the crown jewels of information for credit fraudsters.”

12. Since people’s names, social security numbers, birth dates, etc. never change, the information can be used to defraud and steal from consumers without a shelf life.

13. According to Equifax, the credit card numbers of at least 209,000 consumers were also lost in the hack.

14. Just as concerning, the compromised data may include user names, passwords, security questions and other login information for Internet websites and other financial accounts.

15. In the wake of the breach, two high-level Equifax employees stepped down this week, Chief Security Officer Susan Mauldin and Chief Information Officer, Dave Webb.

16. Shocked by the magnitude of the breach and the revelation that Equifax hid it from the American people, Equifax stock plummeted, falling from $142 per share to $92 as per the time of this writing.

17. Both the FBI and the Federal Trade Commission have initiated investigations into the hack, as well as possible Equifax impropriety. Additionally, the state attorney general of Massachusetts is suing the credit giant, and class action suits are also springing up by the day.

18. So what is Equifax doing to try and remedy the problem? The credit firm has set up a special website where consumers can log in and see if their data was included in the 143 million stolen by hackers.

19. However, you need to enter your last name and social security number to access their website – which is questionable considering the circumstances.

20. Equifax is also extending the offer of free credit monitoring service, called “TrustedID Premier,” for a year to those affected.

21. TrustedID Premier includes credit monitoring of Equifax, Experian and TransUnion credit reports, a credit freeze for Equifax accounts, identity theft insurance, and a monitor to see if someone is trying to sell your social security number on the internet.

22. This may sound sufficient, but critics argue that Equifax isn’t completely forthright about their help. For instance, once the year offer expires, the service is no longer free but costs $19.95 per month. (Consumers actually have to enter their credit card number just to enroll in Equifax’s “free” year-long monitoring service.)

23. It’s been slammed as a back-door way for Equifax to reduce their liability, too. Buried within the fine print when you sign up for TrustedID Premier was a release of liability, renouncing your rights to later sue Equifax or participate in any class action suit.

24. Lambasted in the media and pressured by consumer rights groups, Equifax quickly softened the language of this release to “the arbitration clause and class action waiver included in the Equifax and TrustedID Premier terms of use does not apply to this cyber-security incident,” as well as allowing consumers to opt-in.

25. So what should you do now?

Don’t wait until your financial accounts are hacked or your identity stolen until you act. In fact, we can almost ensure that there are more big data hacks coming, since 65% of Fortune 100 companies still use that same processing framework (called Apache Struts) that was so easily hacked at Equifax.

The best thing to do is to be proactive, starting with checking your credit reports in detail (not just score).

From there, we recommend utilizing these tools to protect your identity and finances:

Credit monitoring

Whether you take advantage of Equifax’s offer or use a trusted third-party service, credit monitoring will keep tabs on your credit report for signs of fraud or impropriety.

Fraud alert

Establish fraud alerts with each of the three major credit reporting agencies, Equifax, Experian and TransUnion, as well as alerts for each of your credit and debit cards.

Credit freeze

A credit freeze goes a step beyond fraud alerts in protecting you, which locks your credit files. No new accounts can be opened in your name without going through a security protocol, and only companies that you already commonly do business with will be able to make charges on your cards.

Change your passwords

It’s a good time to go through and change your passwords, for all Internet sites as well as banking, credit, and financial services. Make sure these are secure, not based on your address, birthday, name, or any personal information, and stored in a safe place.

***

In this extraordinary time of confusion and risk, we’re happy to provide you the information and tools you need to protect your credit – and your family’s financial future. Feel free to contact us anytime for a no-cost credit consultation.