Your FICO® score is a major factor when it comes to getting approved for a loan or new credit. In fact, the Fair Isaac Corporation (FICO) is used by 90% of top lenders and banks around the country to help gauge whether you’re a good candidate for new credit, as well as the interest rate they’ll offer. In total, it’s estimated that FICO scores are used for up to 10 billion decisions about credit around the world each year!

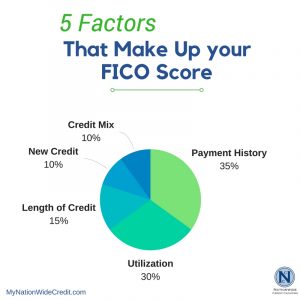

However, FICO has closely guarded their credit scoring algorithms, so we don’t know exactly how their computations will raise or lower our scores. But the good news is that FICO does publicize the specific factors that play into a credit score.

“FICO scores give the most attention to how you have paid back lenders in the past,” says FICO spokesman Craig Watts, “and how much you are using of the credit available to you, as shown on your credit report. Those two factors contribute roughly two-thirds of a typical person’s FICO score.”

Let’s take a closer look at those five factors that go into your FICO score:

35 % of your total FICO credit score.

The single most important factor that influences your FICO score is your record of replaying past debts. This makes perfect sense, considering that past behavior of paying off debts on time and in full is the biggest predictor of future repayment.

When it comes to your payment history, FICO looks at both revolving loans, such as your credit cards, and installment loans, like mortgages or student loans. In fact, we do know that your FICO score will drop more if you miss a payment on a large installment loan, like your home mortgage, over a smaller credit card, for instance.

To achieve a great credit score:

The single best way to improve your FICO or keep it high is to make all of your payments on time every single month.

Credit Utilization

30 % of your total credit score.

Almost as prevalent as payment history is your credit utilization, or the percentage of available credit compared to what you already owe. Creditors are wary to lend more to consumers who consistently max out their revolving accounts and consistently spend up to their limit without a buffer. Their research shows that these folks are more likely to miss payments or default in the future f they’re already constantly spending every dollar they have available as credit.

To achieve a great credit score:

Common advice is to keep all of your credit cards and revolving debt at around 30% of the total available credit. However, FICO’s research shows that borrowers with the highest credit scores tend to have a credit utilization ratio around 7 percent or so.

Length of Credit History

15 % of your total credit score.

All accounts aren’t created equal when it comes to credit scoring, with the accounts that have been open the longest helping your score more than recently opened ones. This factors into your length of credit history, as well-seasoned accounts are a better indicator of a consumer’s responsible payment pattern. Therefore, even if they’ve never missed a payment or done anything wrong, a borrower with only new tradelines on the credit report will never have a perfect score.

To achieve a great credit score:

Make sure to keep older accounts in good standing and think twice about paying off and closing any well-seasoned accounts (including with balance transfers), as it may hurt your score.

New Credit

10 % of your total credit score.

About 1/1oth of your FICO score is determined by what kinds of new credit you’re adding – and applying for. When consumers start applying for credit cards and other credit too often within a short period of time, it indicates financial desperation or risky spending patterns, and their score may drop accordingly. The exception is when borrowers are applying for a big purchase like a mortgage or auto loan, as it’s expected that they’ll “shop around” a little.

To achieve a great credit score:

Don’t apply for new credit frivolously, and mind the quality of the new tradeline, too. Just because every retail store, department store, and credit card mailer is offering you more credit, you probably don’t want to take it.

Credit Mix

10 % of your total credit score.

To show a healthy mix of credit and financial acumen, FICO looks for a mix of different credit accounts, including credit cards, retail accounts, installment loans, finance company accounts and mortgage loans. If a consumer has all credit cards, for instance, it may indicate a risky imbalance, and their score would be dinged accordingly. FICO’s data has shown that if a borrower has a good mix of credit, they have a higher chance of paying on time in the future.

To achieve a great credit score:

Take a look at the type of credit accounts on your report and balance it out with an installment loan, paying off an unneeded credit card, etc.

***

We now know the five factors that go into your FICO score, and what best practices to follow to keep a great credit score. However, your situation could be a little different based on what’s on your credit report and your credit history, so you should get help from a credit professional to maximize your score.

If you’d like help with your FICO score, contact us for a free consultation today!