-

Quick Contact

Get A free

Consultation Now!

Tag Archives: retire

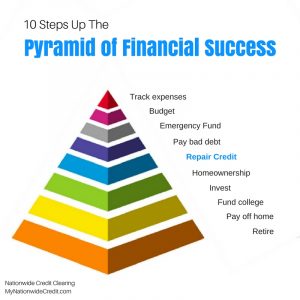

The Pyramid of Financial Success

The Pyramid of Financial Success

The Pyramid of Financial Success

No matter what our financial situations look like, everyone pretty much wants the same thing: low bills, plenty of savings, living in our own home, and enough investments to retire whenever we wish. Achieving that lofty goal is also very obtainable if you follow these 10 steps to climb the Pyramid of Financial Success:

1. Track expenses

Before you do anything else, it’s critical to know exactly how much you’re spending every month, and on what. Sure, you may THINK you know what your bills are and how much you spend, but I bet that you’ll be pretty shocked when you write down every single penny you spend (or use one of the great financial apps that help you record expenses). Try this for a month and then add up the total expenses and you’ll be amazed how much you’re blowing on impulse purchases, things you don’t really need or even want, and items that you didn’t realize are costing you!

2. Set a budget

Now that you know exactly what you’re spending your hard-earned dollars on, it’s time to tighten the belt. Ruthlessly slash everything from your budget that’s not a necessity – and hold yourself accountable to it. This will take some discipline but turn it into a fun game, and keep reminding yourself that by sacrificing NOW, you’ll be able to put yourself in a much better financial situation that lets you spend more on the things you really love and want later on.

3. Build an emergency fund

Did you know that 40 percent of Americans couldn’t come up with $400 in cash if faced with an emergency today, and two-thirds don’t have even $1,000 saved? As we’ve turned to debt more and more, the savings deficit in the U.S. has grown. However, it’s so important that you accumulate a rainy-day fund, which is a fair bit of cash that you can use when the car breaks down, you miss work because of a medical problem, or some other challenge. Start by putting $400 away, then $1,000, and keep saving until soon, you’ll have at least a few month’s total expenses saved as a cushion.

4. Pay debt

This is a big one! Once you’ve set a budget and put aside a few bucks as a safety net, it’s time to tackle the hardest part of all: paying off debt. In fact, the average American household now has $16,883 in credit card debt, $50,626 in student loans, $29,539 in auto loans, and, if they’re lucky, a mortgage on top of all that. But the one that we want to start with is paying off credit cards, as well as other revolving debt and retail installment loans. This is essential if you want to free yourself from a life of struggling and stressing about money and bills, and open up a much more secure and comfortable relationship with money.

There are several ways you can pay off your debt, but one of the best is using the technique of Debt Snowballing which is advocated by financial gurus Dave Ramsey, Suzie Orman and others. We’ll bring you more info on Debt Snowballing soon.

5. Repair credit

In fact, it’s a good idea to tackle #4 and #5 on this list in conjunction so that you’ll end up debt free AND with a fantastic credit score, starting with a free credit report and consultation from Nationwide Credit Clearing. We’ll go over your credit report and debt load with you, identifying which of them should be paid off first since they have the highest interest rates (or smallest balances).

Likewise, we can advise you which of your credit accounts should just be paid down (not off) and kept open. Our service will also attempt to remove negative, incorrect, and outdated items from your credit report, boosting your score to new heights.

How important is a great credit score? These days, just about everything you pay is tied to credit score, from all of your credit cards, your mortgage, and other loans, as well as utilities, cell phone accounts, the ability to rent a home, and even your job!

6. Buy a house

Speaking of (not) renting, once you have some savings and your debt paid off, the next big step in your financial pyramid is buying your own home. In fact, homeownership is still the American Dream, allowing you to build equity, pay down your loan, enjoy lucrative tax breaks, and experience the pride of ownership. These days, down payment programs make it easier than ever to come up with the money needed to buy a house, and you’ll essentially be paying yourself every month instead of your landlord!

7. Invest

Your bad debt is gone, and you’re now in your own home, so it’s time to start investing. Actually, you should be investing from day one in a 401K, mutual fund, or other safe, stable vehicle, as the power of compounding really comes into play the earlier you start. Contact a financial planner or advisor for the best way to invest and save for retirement considering your situation and goals.

8. Fund college

Remember how we mentioned that the average household has $50,000+ in student loan debt? Why not give your children a head start (not extra hurdles) in life by funding as much of their college education as possible instead of piling on more debt?

9. Pay off your home

We paid off your bad debt when we zeroed-out those credit cards, and you’ll get to a point high up the pyramid of financial success where the next logical step will be to pay off your home, too. There are several great strategies to help you do this, such as sending in a 13th payment every year, paying every two weeks instead of monthly, or adding extra funds to pay off principal faster. Either way, once you pay off your home in 20 or even 10 years instead of 30 (like most mortgages), your biggest bill will be knocked off the list.

10. Retire

With little or no debt, plenty of savings, a well-spring of investment income, and your home paid off, you’ll be in the enviable position at the top of the pyramid, where you can choose to retire whenever you like. Of course, that doesn’t mean that you must stop working, as many people opt to pursue their passion or work a lighter schedule just because it’s enjoyable. Either way, you’ll be the master of your financial life – not the other way around! Congratulations on making it to the top of the pyramid!