-

Get A free

Consultation Now!

Tag Archives: Men and women credit scores

How men and women differ when it comes to credit and debt.

How men and women differ when it comes to credit and debt.

How men and women differ when it comes to credit and debt.

There are some profound differences between men and women when it comes to men and women, from what we earn, to what we spend our money on, and even how we go about investing. When it comes to credit and debt, there are some interesting comparisons between males and females, too – although it might not always be what you think.

For instance, when it comes to credit score, would you guess that men or women are leading the way with better scores?

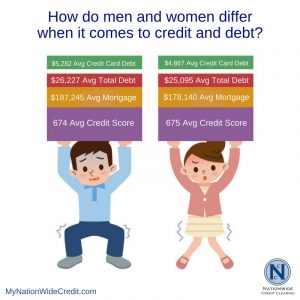

In fact, according to surveys by Experian, women have a higher average credit score (675) than men (674).

Men have more debt, with an average of $26,227 compared to $25,095 for women.

The average man owes $5,282 in credit card debt, compared to only $4,867 for women in credit card balances.

Women have 4.1 credit cards on average, while the average man only carries 3.7 cards.

But at least part of that debt total for men can be attributed to home loans. Of all people who are mortgage holders, men have an average of $187,245 in home loans compared to $178,140 for females.

In fact, the average U.S. man has $50,425 in mortgage debt versus only $35,116 for the average American woman.

Another check in the “Men” column is that 60% of men have more savings than credit card debt, while only 49% of women have more in their savings account than their credit card balances.

While both sexes sometimes exhibit less than stellar use of credit cards, women lead the way in a metric called “problematic behaviors” when it comes to cards.

In fact, only 33% of men display two or more problematic behaviors with credit card usage, compared to 38% of women.

But men carry a larger total of debt than women (+4.3%), and females also use only 30% of their available credit, while men use 31% or higher on average.

Men comparison shop for better rates and terms on their credit cards more than women (37% to 31%).

Women also carry a bigger balance from month to month on their cards (60% do so) compared to men (55%).

And 42% of women only make the minimum payment every month, compared to only 38% of men (a big no-no for your credit score).

Backing up that statistic, 45% of men pay their balance in full every month, compared to only 39% of women.

Women also pay late fees on their credit cards far more than men, at a rate of 29% (of women who have to pay late fees) versus only 23% of men.

Despite having lower credit scores (slightly), men also have better interest rates on their credit cards than women. In fact, the average rate for men is 14.3%, compared to 14.9% for women’s credit cards.

How about student loan debt? On a per-student basis, women have far more student loan debt than men. In fact, the average woman has $11,786 in student loans, compared to only $8,187 for men.

But men finance far more for their cars, with an average auto loan tally of $8,249, while women only owe $6,693 on their car loans on average.

While the one-point credit point advantage favors women by a small margin, the data reveals that women do have a better understanding of credit scores and credit reporting. The Experian study concluded that:

48% of men incorrectly believe that marital status factors into credit scores, compared to only 38% of women who mistakenly think the same thing.

46% of men mistakenly think marital status is a factor in scoring, versus only 34% of women who get that wrong.

74% of women understand that the credit bureaus collect the information that’s used for scoring, while only 68% of men realize that.

Women are more apt to know when scores are free (65%) than men do (60%), know when lenders are mandated to discloses scores (53% to 46% for men), and better understand the importance of regularly checking and monitoring their credit reports (77% to 72% for men).

***

So which gender wins the title of “Best with Credit and Debt?” It seems like women win out over men on average in certain important factors, but men are profoundly better in a few others. Overall, well call it a tie and just say that BOTH men and women need to work hard, educate themselves, and do better with credit and debt if they want to improve their finances and get ahead!

And you can start with a free credit report and consultation from Nationwide Credit Clearing! Contact us to get started.