While millions of Americans just filed their taxes in hopes of a big refund, consumers may be getting some good financial news in another arena: their credit scores. That’s because the three major credit reporting bureaus – Experian, Equifax, and Transunion, just reported that they’ll start excluding tax liens from their credit scoring algorithms.

While millions of Americans just filed their taxes in hopes of a big refund, consumers may be getting some good financial news in another arena: their credit scores. That’s because the three major credit reporting bureaus – Experian, Equifax, and Transunion, just reported that they’ll start excluding tax liens from their credit scoring algorithms.

In a concerted effort to improve the accuracy and fairness of their scoring models in respect to public records, a significant number of Americans will see their credit scores jump, virtually overnight (the changes took place April 16.)

The push for reformatting the way judgments and tax liens are factored into credit scoring comes after a study from the Consumer Financial Protection Bureau revealed that incorrect, outdated, or otherwise erroneous information too-often showed up in credit files, sinking that person’s score. So, starting last July, the credit bureaus started their clean sweep of civil judgment data from credit reports, including some tax lien reporting. This April 16, they finished that job.

To be clear, the vast majority of Americans won’t see any difference if they check their credit score again. According to the IRS and other reports, between 93% and 94% of Americans do not have any sort of tax liens reporting on their credit. However, that still leaves about 12 to 14 million Americans that may have tax liens or other judgments affecting their credit score.

The number of people who see a credit score benefit could be even higher. Based on research by LexisNexis Risk Solutions, about 11% of our population will have a judgment or tax lien removed from their credit file.

No matter how you add it up, since the credit bureaus are reshuffling their credit scoring model and excluding tax liens from consideration, these “lucky” millions of consumers will enjoy that sizable score increase.

So, just how high might their scores increase with the new scoring changes?

The answer is “It depends,” of course, because credit scoring is based on a host of factors and individual circumstances (like payment history, status of other existing loans, how seasoned accounts are, and credit mix). While many consumers may see their FICO score up by about 10 points after the April 16 change, a whole lot more could see their score ascend even higher.

For instance, according to a study of 30 million credit files by credit scorer FICO:

• The majority of consumers will see an increase of about 1 to 19 points.

• But between 1 and 2 million consumers may see their scores skyrocket by 20 to 39 points.

• In the case of about 300,000 consumers, their credit scores could go up by as much as 60 points when multiple liens are removed – or more.

But, it’s important to remember that the vast majority of people won’t see any credit score increase at all, as they don’t have tax liens or judgments. Others point to the fact that the 92-93% of consumers who don’t have a tax lien are somehow unduly being penalized because they won’t see their score go up.

Likewise, various financial watchdog groups have gone on record that the changes won’t make a big impact for consumers, at all. According to Eric Ellman, senior vice president of the Consumer Data Industry Association, “Analyses conducted by the credit reporting agencies and credit score developers FICO and VantageScore show only modest credit scoring impacts.”

But wait, is it possible that the credit scoring changes not only make a minimal impact but even harm consumers? “Lenders and servicers have to hedge for that risk,” says Nick Larson, business development manager for aforementioned LexisNexis Risk Solutions. “Overall, consumers actually get hurt,” he goes on, pointing to the fact that banks, lenders, and creditors will have to adjust their guidelines and regulations accordingly (therefore hurting those who didn’t see a credit score increase from erasing tax liens) just to provide the status quo risk-gauging model.

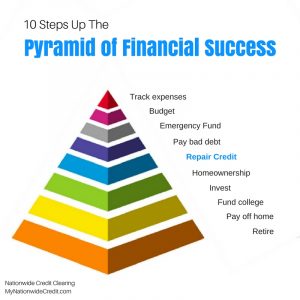

No matter what the temporary impact may be, remember that the best way to maintain a great credit score over the long term – and save thousands on your credit cards, mortgages, loans, and more – is to make your payments on time, keep your balances low, and keep a good mix of seasoned, responsible accounts.

For more help or if you’d like a great credit score increase of your own, contact Nationwide Credit Clearing for a free report and consultation.